SHORT-TERM: IN WAIT AND SEE MODE

To read today’s report, you must be very clear about different time frame. It’s a little bit confusing if you’re not experienced, so I’d like to summarize below first:

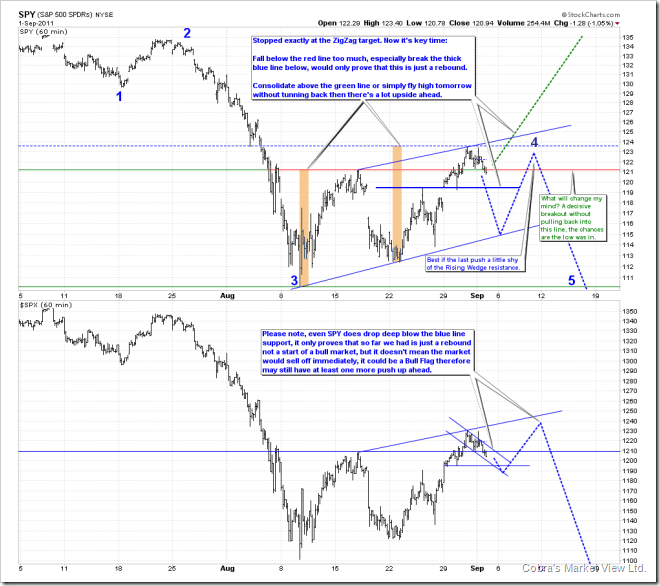

- The bigger picture, whether the rally we had so far is merely a rebound, we need see tomorrow for further pullback to produce enough price overlap.

- The big picture, the current rally may not be over because till now we cannot exclude the possibility that a Bull Flag is in the forming on the SPY 60 min chart.

- The smaller picture, i.e. tomorrow, may see further pullback or gap down tomorrow morning, but may not close in red eventually.

The pullback today was not big enough to produce a clear price overlap, so kind a key tomorrow again. Also as summarized above, even there’s a further pullback tomorrow to produce enough price overlap, it can only prove that the rally we had so far is just a rebound, but it does not mean the rally is over and the market going to test the Aug 9 lows immediately, because as long as it’s not a sharp down tomorrow then it could be a Bull Flag in the forming therefore there could be at least one more push up ahead.

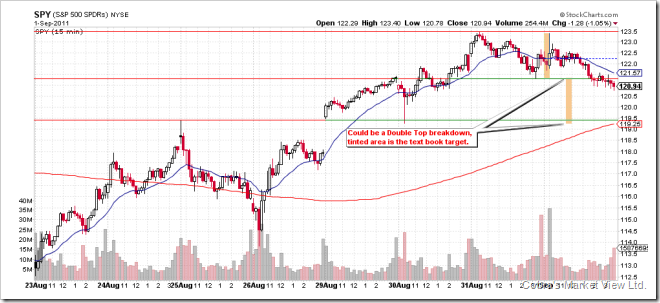

Although there’re some chances we’ll see further weakness tomorrow morning, as in 15 min chart, could be a confirmed Double Top breakdown, but I’m not sure whether the day will eventually close in red, because seasonality wise, the last trading day before the Labour Day was more likely green plus tomorrow is Non Farm Payroll day which had 60% chances to close in green.

About the intraday pattern for tomorrow Non Farm Payroll day, more likely to open high go lower or open low go higher. In the current situation, I think this kind of pattern becomes even more likely because good data would mean no QE3, so the market may gap up but fall down, while bad data would mean QE3, therefore the market may gap down then rally into the close. The statistics below is from Bespoke.

INTERMEDIATE-TERM: SPX DOWNSIDE TARGET IS 1,000, THE CORRECTION COULD LAST 1 TO 2 MONTHS

See 08/19 Market Outlook for more details.

SEASONALITY: BEARISH TUESDAY, BULLISH THURSDAY

According to Stock Trader’s Almanac:

- August’s next-to-last trading day, S&P up only twice in last 14 years.

- First trading day in September, S&P up 11 of last 15, back-to-back huge gains 1997 and 1998, up 3.1% and 3.9%.

Also please see 07/29 Market Outlook for day to day August seasonality chart.

ACTIVE BULLISH OUTLOOKS:

- N/A

ACTIVE BEARISH OUTLOOKS:

- N/A

SUMMARY OF SIGNALS FOR MY PUBLIC CHART LIST:

| |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||

|