SHORT-TERM MODEL THINKS THE TREND IS DOWN, HOLDING LONG (TRAPPED) AND SHORT OVER THE WEEKEND

First of all, take a little time to poll here. I plan to do this on regular basis so that we’ll have our own sentiment poll.

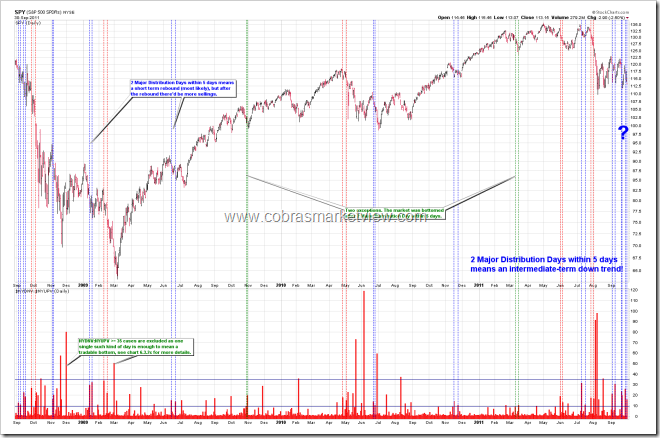

The bottom line, no good for bulls for the following few weeks as mentioned in the last night report if no huge up today. I’ll present my witness in the weekend report, so stay tuned. That’s for a little bit longer time frame though, the short-term is still hard to say because, see below, 2 Major Distribution Day within 5 days usually means a huge rebound and I’m sure you all remember how the market rebounded recently, really really powerful, right? So bears no champagne please, the fighting is not over yet.

Bullish biased toward the next Monday for 2 reasons:

Two Major Distribution Day within 5 days had led to a rebound starting from next trading day, 12 out of 17 (71%) times and most likely the rebound won’t be small.

The day after a Major Distribution Day has 64% chances to close in green.

Cobra Impulse System will try to sell short again the next Monday. See table below for more details. I know that “close in red or green” kind of confirmation really makes the trade difficult. I’ll find time to see if there’s any better solution for this.

Enjoy your weekend!

| MECHANICAL TRADING SIGNALS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| DEMO ACCOUNT FOR SHORT-TERM MODEL (Attention: This is not part of Cobra Impulse System) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|