SHORT-TERM: WE MIGHT HAVE ONLY ONE DOWN DAY UNTIL FOMC

The bottom line:

- Could see red Monday.

- May not be bullish the next week.

Maintain the conclusion drawn in 09/15 Market Outlook: At most one red day before FOMC on September 21, the big picture however is still down unless the red line in the chart below is decisively broken. Trading wise, for the short-term, I’ll buy next dip or breakout. In 09/12 Market Outlook, I said the low might be in and in 09/14 Trading Signals, I clearly said I’d rather long, so even eventually it proves that my big picture is wrong, the actual trade should guarantee that there’s not much loss in this round. The reason I mention this is: Firstly and the most importantly, apparently I’m trying to leave myself a back door now in case I’m totally wrong about the big picture. You definitely can regard this as my way of capitulation on bearish call therefore it could mean the market is topped (Oops I forgot to put LOL here). Secondly, again, I just want to make sure you all know the different timeframe I’m talking about.

As mentioned about, there could be one red day before the FOMC, for now, it looks to me such a red day could be the next Monday. I should have explained a little more in the Friday’s Trading Signals, as I really meant it’s not the reason to short when SPX rose 5 consecutive days while under MA(200), I didn’t really mean that 70% green as the sample size is a little small. Anyway, from all the evidences I’ve collected so far, at least statistics are conflicting each other therefore the green Monday is not a sure thing anymore.

An unique thing on Friday was that SPX rose 0.57% while NYMO actually turned down (pay attention to my wordings here: “turned down”). I know that NYMO is actually MACD(19, 39, 1) on NYAD, so theoretically its turning down should only mean the up momentum is weakened, but the test result somehow shows that there’re 87% chances a red Monday.

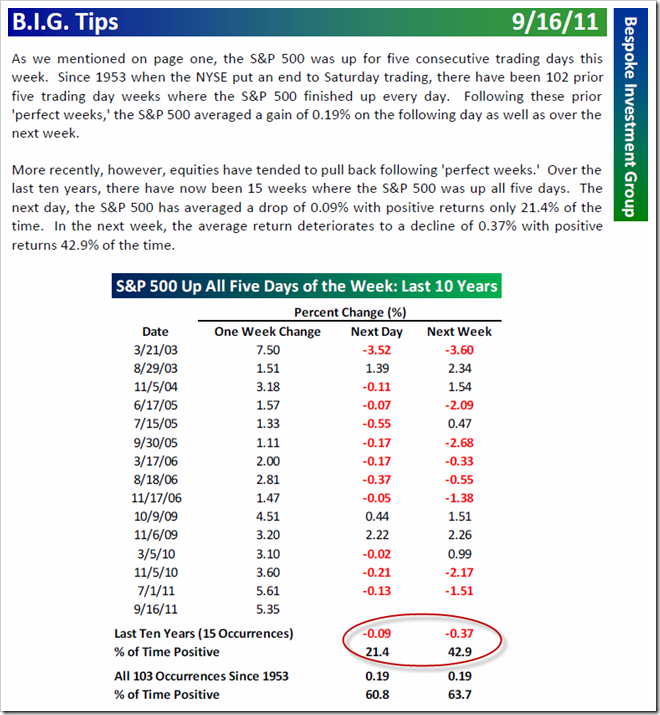

The statistics below is from Bespoke, also looks like there’re 79% chances for a red Monday. Besides, plus the bearish seasonality for the next week (see seasonality session below), it could also mean the next week might be red as well.

The chart below is from Sentimentrader, could be another reason for not bullish the next week, as I’ve noticed that this Down Pressure indicator is pretty reliable so if it works again this time, we should be very close to a short-term top now.

INTERMEDIATE-TERM: SPX DOWNSIDE TARGET IS 1,000, THE CORRECTION COULD LAST 1 TO 2 MONTHS

See 08/19 Market Outlook for details.

SEASONALITY: BEARISH WEEK

According Stock Trader’s Almanac, week after September Triple Witching, Dow down 16 of last 20, average loss since 1990, 1.1%.

See 09/02 Market Outlook for September seasonality.

SUMMARY OF SIGNALS FOR MY PUBLIC CHART LIST:

| ||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

|