| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SHORT-TERM: COULD BE A RED WEEK AHEAD

For 2 reasons, I expect a red week the next week.

4.1.0 S&P 500 Large Cap Index (Weekly), SPX this far above MA(200) had led to a week or two pullbacks recently.

OEX Put Call Ratio is way too high, looks a little little bit bear friendly for the short-term.

The 3rd reason is mostly from experiences not a solid proof. Every time a sudden wide range bar emerges suddenly out of a series of small bars, my first reflection is that it could be an exhaustion bar. If you pay a little attention to the seasonality session below, then you’d notice that NASDAQ down 8 of last 10 for the next week. By the way, the February expiration week (the next next week) and the week after (the next next next week), both are bearish. (Yes, that’s total 3 bearish weeks, in terms of seasonality)

INTERMEDIATE-TERM: WHETHER THIS IS PRIMARY 3 OF 3 TO GALAXY FAR FAR AWAY WE MAY KNOW WITHIN 2 WEEKS

Begin with the conclusion first:

- If SPX has no 2.5%+ pullback within the next 2 weeks, then chances are very good that it will not have any 2.5%+ pullback for another 89 trading days. In another word is that chances are good that what we’re experiencing now is not merely an ABC rebound, instead it’s the Primary 3 of 3 to Galaxy far far away.

- On the other hand, if there is a 2.5%+ pullback, it can only mean that bears still have some hopes for the ABC rebound being still valid, but it cannot prove that it won’t turn out to be a Primary 3 of 3 eventually.

- Even there is a 2.5%+ pullback, 77% chances, the high (say, the Friday’s high at 1311) we had or going to have, will be revisited. I won’t discuss this 77% possibilities in today’s report but if you’re interested, you can take look at 11/12 Market Recap.

So, the bottom line, even the worst case is not really bad for bulls as the pullback if indeed, could be another buy opportunity.

The chart below provides a little background about the conclusion I said above. The left side is the bullish count, very very bullish as I don’t know where the end of primary 3 would be; On the right side is the bearish count that accordingly we may now very close to the end of wave 5 and therefore the wave C. To me, I don’t care which count is correct, because even the bullish count still has to pass all the target (pivot) given by the bearish count, so in all my previous intermediate-term analysis, I use the bearish count. By the way, from the chart we can see the next few targets are 1360, 1381 and 1428.

OK, now let’s talk about the reasons for “SPX 2.5%+ pullback within 2 weeks or never”.

The chart below is the main reason which I’ve already used in the 11/08 Market Recap (and being proven right). Amazingly whenever the SPX has been up without 2.5%+ pullback, there’s a threshold between 40 to 61 trading days when most straight ups ended within this range. If, however, the 61 trading days threshold was overcome, then the straight up could last for another 89 trading days to total 150 trading days. Now we’re on day 55, which is to say that if within the next 6 trading days, we don’t have a 2.5%+ pullback, then chances are very good that SPX could go straight up for anther 89 trading days, and if so, obviously the count for ABC rebound is wrong, instead what we’re seeing now is the primary 3 of 3 (to Galaxy far far away). Agree?

The chart below is another reason. Ever since the March 2009 rally, the major push ups have lasted 44 to 54 trading days. Since now we’re at the 46th trading day so chances are good that the current push up could end within the next 8 trading days. Besides this, if you count 8 trading days from now, you’ll see it happens to fall into the most bearish period in February in terms of seasonality. Coincidences? Well, we’ll see.

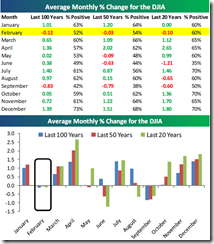

SEASONALITY: BEARISH THE NEXT WEEK FOR NASDAQ, FEBRUARY SEASONALITY IS GENERALLY NOT BULLISH

According to Stock Trader’s Almanac, week before February Expiration Week, NASDAQ down 8 of last 10, 2010 up 2.0%.

The following screenshot about Average Monthly % Change for the DJIA is from Bespoke.

The following screenshot about the February seasonality day by to is from Sentimentrader.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | 01/28 S | |

| NDX Weekly | UP | BPNDX is way too overbought. |

| IWM | ||

| IWM Weekly | DOWN | |

| CHINA | ||

| CHINA Weekly | DOWN | |

| EEM | ||

| EEM Weekly | DOWN | |

| XIU.TO | *02/04 L | *TOADV MA(10) is a little too high, all led to a pullback of some kind recently. |

| XIU.TO Weekly | UP | |

| TLT | ||

| TLT Weekly | *DOWN | |

| FXE | ||

| FXE Weekly | UP | |

| GLD | ||

| GLD Weekly | DOWN | STO is way too oversold, led to a rebound the last 2 times. |

| GDX | 02/03 L | |

| GDX Weekly | DOWN | |

| USO | ||

| WTIC Weekly | UP | |

| XLE | 01/25 S | |

| XLE Weekly | UP | *Too far above MA(200). |

| XLF | 10/15 L | |

| XLF Weekly | UP | Testing resistance which also is multiple Fib confluences area. |

| IYR | ||

| IYR Weekly | UP | |

| XLB | 02/01 L | |

| XLB Weekly | DOWN | BPMATE is way too overbought. |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on daily chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on daily chart.