| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SHORT-TERM: DON’T EXPECT STRONG MONDAY, STILL EXPECT A 2ND LEG DOWN ONCE THE CURRENT REBOUND COMPLETES

Although the Friday’s rebound was strong but I still believe there’ll be a 2nd leg down once the rebound is over. However, if another 1%+ up the next Monday, considering that the next Tuesday is the first trading day of March which suppose to be very very (insert 100 very here) bullish, so in this case, no argue, chances would be pretty high that pullback was over, we’ll see a new high.

Let’s begin with why I believe there’ll be a 2nd leg down:

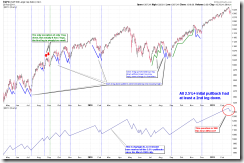

The chart below basically says that since the March 2009 rally, all 2.5%+ pullbacks were 2 legged (down). Strictly speaking, there’s no exceptions. The chart below below marks the “% Change” for every 1st leg down, should be clear that our current 1st leg down is within the normal range so it’s reasonable to expect a 2nd leg down. (In case you wonder why the initial pullback size could justify a 2 legged pullback? Well, it’s the law of inertia that is beyond discussion of this report)

Another evidence was from Schaeffer. VIX rose 35%+ within 2 days, which looks bad thereafter since the March 2009 rally. The statistics from Schaeffer (blue table inside the chart below) also says the next week won’t be pleasant.

So now the question is whether it is possible for the next Monday to rise huge (therefore potentially invalidates my expectation for the 2nd leg down)? All I can say now are it has 20% chances. Here’s a simple statistics, since the March 2009, whenever SPX down 3 consecutive days (why 3 consecutive down days? See 02/24 Market Recap) then rebound 1%+ one day (that’s Friday), buy at Friday’s close then sell at Monday’s close, looks like there’s only 2 out of 10 chances for a green Monday.

Last but not the least, I’d like your attention for three additional things:

0.1.0 SPY Short-term Trading Signals, if you paid attention to the exit conditions in the chart, then most long setups mentioned in the 02/23 Market Recap should have been closed by Friday.

The chart below is from Schaeffer.

Institutional Buying and Selling Trending chart from StockTiming, the next thing I’d watch closely is whether the distribution curve (red) clearly crosses above the accumulation curve (blue). If indeed in the following days, then according to the past, the pullback caused by such a crossover won’t end within a day or two. This could again supports my expectation for a 2nd leg down.

INTERMEDIATE-TERM: PULLBACK SINCE 02/22 COULD LAST 4 WEEKS ON AVERAGE, THE 02/18 HIGH WILL BE REVISITED THEREAFTER

See 02/23 Market Recap for more details.

SEASONALITY: FIRST TRADING DAY IN MARCH COULD BE VERY BULLISH

According to Stock Trader’s Almanac, first trading day in March, Dow down 3 of last 4, –4.2% in 2009, 1996 – 2006 up 9 of 11.

Generally, I’d expect a very bullish March the 1st because according to the table below, ever since the March 2009 rally, the first trading day of the month is very very bullish. Also, for the March seasonality chart please refer to Seasonality – Month.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | 01/28 S | |

| NDX Weekly | UP | |

| IWM | ||

| IWM Weekly | UP | |

| CHINA | ||

| CHINA Weekly | UP | No higher low yet but the rebound is so strong so could be in uptrend now. |

| EEM | ||

| EEM Weekly | DOWN | |

| XIU.TO | 02/04 L | |

| XIU.TO Weekly | UP | |

| TLT | Could be a channel breakout, trend may about to change. | |

| TLT Weekly | *? | |

| FXE | ||

| FXE Weekly | UP | |

| GLD | ||

| GLD Weekly | UP | |

| GDX | 02/03 L | |

| GDX Weekly | UP | |

| USO | Clear breakout on WTIC chart. | |

| WTIC Weekly | UP | |

| XLE | 02/09 S | |

| XLE Weekly | UP | Too far above MA(200). |

| XLF | 10/15 L | |

| XLF Weekly | UP | |

| IYR | ||

| IYR Weekly | UP | |

| XLB | 02/09 S | |

| XLB Weekly | UP |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on daily chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on daily chart.