| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SHORT-TERM: COULD SEE SOME WEAKNESS AHEAD

Still not much to say today, so I’ll skip today’s After Bell Quick Summary. For short-term model, I did nothing today anyway.

I see a possible Bearish Rising Wedge on the SPY 60 min chart. My guess is your first reflection would be, come on, give me a break! Well, let’s see, after all, this Rising Wedge looks perfect to me (3 points validated).

I’m bearish biased toward tomorrow at least don’t expect a big up day for 2 reasons:

- TICK closed above 1000, so most likely a small green or red day the next day.

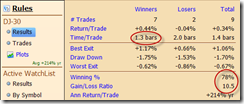

- INDU up 7 days in a row, statistics shows the gain loss ratio is above 10 in addition to the 78% winning rate, if you short at today’s close and cover at the very first down day since 1999.

I posted the most recent Institutional Buying and Selling Trending chart from StockTiming this morning. A friend asked why I think the chart is bearish? Well, the chart below shows a longer history (by combining an old chart together), should be clear that a divergence usually forms prior to the price correction while now the divergence is by far the biggest one. So I think the info given by the chart is bearish and I’ll temporarily maintain what I mentioned in 02/04 Market Recap: 2.5%+ pullback within 2 weeks or never where the 2.5%+ pullback stands a little better chances.

INTERMEDIATE-TERM: WHETHER THIS IS PRIMARY 3 OF 3 TO GALAXY FAR FAR AWAY WE MAY KNOW WITHIN 2 WEEKS

See 02/04 Market Recap for more details.

SEASONALITY: BEARISH THE NEXT WEEK FOR NASDAQ, FEBRUARY SEASONALITY IS GENERALLY NOT BULLISH

See 02/04 Market Recap for more details.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | 01/28 S | |

| NDX Weekly | UP | BPNDX is way too overbought. |

| IWM | ||

| IWM Weekly | DOWN | |

| CHINA | ||

| CHINA Weekly | DOWN | |

| EEM | ||

| EEM Weekly | DOWN | |

| XIU.TO | 02/04 L | TOADV MA(10) is a little too high, all led to a pullback of some kind recently. |

| XIU.TO Weekly | UP | |

| TLT | ||

| TLT Weekly | DOWN | |

| FXE | ||

| FXE Weekly | UP | |

| GLD | ||

| GLD Weekly | DOWN | STO is way too oversold, led to a rebound the last 2 times. |

| GDX | 02/03 L | |

| GDX Weekly | DOWN | |

| USO | ||

| WTIC Weekly | UP | |

| XLE | *02/08 L | |

| XLE Weekly | UP | Too far above MA(200). |

| XLF | 10/15 L | |

| XLF Weekly | UP | Testing resistance which also is multiple Fib confluences area. |

| IYR | ||

| IYR Weekly | UP | |

| XLB | 02/01 L | |

| XLB Weekly | DOWN | BPMATE is way too overbought. |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on daily chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on daily chart.