| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SHORT-TERM: PRICE ACTION ARGUES FOR MORE UPSIDE, BEAR’S BEST BET IS TIME RESISTANCE

The bottom line, now looks like it’s even a luxury to hope a 2.5%+ pullback from high to low, as chances are good that the market may continue up from here especially if we see a bullish follow-through either the next Monday or Tuesday. The bear’s best bet is the time resistance, if indeed there’s a reversal, then also it’s either the next Monday or Tuesday. Considering the fact that trading is art not science, so let’s allow both bulls and bears a few more days, say the whole week the next week to see who stands last.

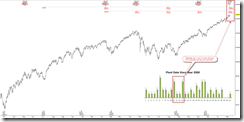

As mentioned in 02/10 Market Recap, if we’re still on Earth, then the law of inertia should always apply, so a strong up momentum like INDU up 8 consecutive days shouldn’t simply reverse sharply down all of sudden. In the Friday’s After Bell Quick Summary, I also mentioned, the Friday’s up doesn’t look like a follow though to the Thursday’s red day, therefore excludes the 5 out of 9 immediately 2.5%+ pullbacks cases shown on chart below. Instead, chances are that INDU may continue up from here and so will the other indices, especially if the next Monday or Tuesday could have a decent up (to follow-through the Friday’s up).

Now, let’s see bear’s best bet as interestingly enough multiple time resistances confluences from this Friday until the beginning of the next week.

- Firstly, it’s the max to 61 trading days without 2.5%+ pullback threshold mentioned in 02/04 Market Recap. We’re now on the 60th trading day.

- Also as mentioned in 02/04 Market Recap, since the March 2009, all the major rallies have lasted max to 54 trading days and we’re now on the 52th trading day of the current rally. Besides, the chart below also shows 2 major cycles due from 02/11 to 02/13 and in addition, statistically, day 11 and 14 of each month since year 2000 are one of most likely pivot days.

The last but not the least, here’s the latest poll for how many bears still standing from my forum, for fun only because you may argue that the choices are not fair for bears. LOL. Again, the poll is in Chinese but I happens to know some English.

INTERMEDIATE-TERM: WHETHER THIS IS PRIMARY 3 OF 3 TO GALAXY FAR FAR AWAY WE MAY KNOW THE NEXT WEEK

See 02/04 Market Recap for more details.

SEASONALITY: BEARISH THE NEXT MONDAY AND FRIDAY

According to Stock Trader’s Almanac:

- First trading day of February Expiration week Dow down 4 of last 6.

- Day before Presidents Day weekend, S&P Down 16 of last 19.

- February Expiration day, Dow down 7 of last 11.

The seasonality surrounding Presidents Day below is from Sentimentrader.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | 01/28 S | |

| NDX Weekly | UP | BPNDX is way too overbought. Too far above MA(200). |

| IWM | ||

| IWM Weekly | UP | |

| CHINA | ||

| CHINA Weekly | DOWN | |

| EEM | ||

| EEM Weekly | DOWN | |

| XIU.TO | 02/04 L | TOADV MA(10) is a little too high, all led to a pullback of some kind recently. |

| XIU.TO Weekly | UP | |

| TLT | ||

| TLT Weekly | DOWN | |

| FXE | *Watch for possible 1-2-3 trend change to down from up. | |

| FXE Weekly | UP | |

| GLD | ||

| GLD Weekly | DOWN | |

| GDX | 02/03 L | |

| GDX Weekly | DOWN | |

| USO | ||

| WTIC Weekly | UP | |

| XLE | 02/09 S | |

| XLE Weekly | UP | Too far above MA(200). |

| XLF | 10/15 L | |

| XLF Weekly | UP | Testing resistance which also is multiple Fib confluences area. |

| IYR | ||

| IYR Weekly | UP | |

| XLB | 02/09 S | |

| XLB Weekly | UP | BPMATE is way too overbought. |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on daily chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on daily chart.