Summary:

Breakout but I'm not convinced.

Still expect a short-term pullback soon.

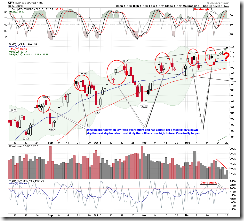

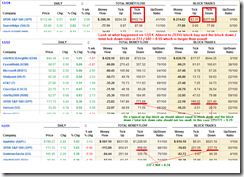

INTERMEDIATE-TERM: BREAKOUT BUT I'M NOT CONVINCED 5.0.1 S&P Sector SPDRs I (Daily), breakout, yes, but since the SPY and QQQQ are not in syn plus the very thin holiday volume, so I'm not convinced.

I know you’re now so used to ignore the volume. Well, OK, let me present some other reasons why I'm not convinced.

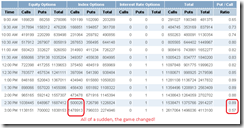

The chart below shows clearly that COMPQ had the breakout on 5 consecutive unfilled gaps! I don’t remember I’ve ever seen this kind of breakout before. 1.0.2 S&P 500 SPDRs (SPY 60 min), 15 unfilled gaps, the highest record so far this year. 1.1.0 Nasdaq Composite (Daily), even according to the more strict rules, COMPQ has 9 unfilled gaps now, also is the highest record this year.

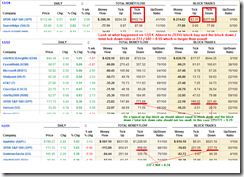

Let’s take a look at block sell. The chart below highlighted all the SPY block sells for 12/21, 12/22 and 12/24. Apparently the 12/24 SPY block sell was unusual. OK, now let’s look back at the chart 5.0.1 S&P Sector SPDRs I (Daily). It’s the 12/24 bar made the SPY breakout look real, isn’t it? Then, why bigger than usual block sell on the same day?

3.0.0 10Y T-Bill Yield, this chart argues for a top now. Please refer to 8.2.7 Market top/bottom by ROC30 of 10Y T-Bill Yield 2005-2008 and 8.2.8 Market top/bottom by ROC30 of 10Y T-Bill Yield 2001-2004 for the past performances. Surprisingly, this signal worked very well in the past. Of course for calling a top, the signal sometimes could be a month earlier, so for now, we don’t need to worry about much. The actual stuff I want your attentions are:

- Yield rose too fast and it has more upside ahead. This is not good for the economical recovery. (What? The economy has already recovered, so it’s OK the mortgage keeps rising. Well, #$%^&#$%!)

- Pay attention to the IRX above, the 3 month yield, strangely, it dropped a lot while the market was rising. This is a sign of flight to safety which usually means an imminent pullback.

SHORT-TERM: COULD BE A PULLBACK SOON

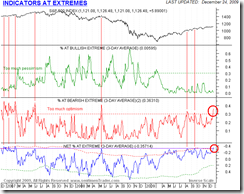

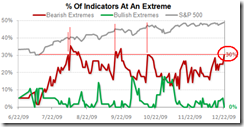

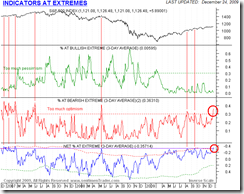

I still expect a short-term pullback soon. The main reason still is that there’re too many indicators at bearish extremes in www.sentimentrader.com. The chart below shows a longer history when there’re so many indicators at bearish extremes. Trading wise, if you really want to short this rally, take a look at the trend table above, this is a countertrend trading so better wait for a Bearish Reversal day before taking serious any actions.

4.1.1 PowerShares QQQ Trust (QQQQ Weekly), 4.1.9 SPX Cycle Watch (Weekly), it should be more clear on the QQQQ Weekly chart that multiple cycle turn dates are due therefore quite likely the market could turn down the next week.

Take a look at the chart below, sent by my friend Uempel, he gives almost the same cycle turn date.

INTERESTING CHARTS:

The most recent II and AAII Survey.

I think I’ve mentioned this several times, when there’re not many II bears, the market may not be up much.