Summary:

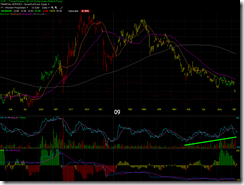

Worden proprietary indicator TSV shows negative divergence on the SP-500 chart.

US$ could rebound soon.

Some short-term indicators are overbought.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Up | ||

| Intermediate | Down | Neutral | |

| Short-term | Up | Neutral | |

| My Emotion | Wait | Could repeat what happened after 8/17, so be careful bears. |

Since www.stockcharts.com still is down so as promised let’s take a quick look at some charts form Telechart.

TSV divergence seems worked well on the SP-500 chart, which is one of Don Worden’s proprietary indicators – similar to money flow indicator.

TSV on UUP chart shows positive divergence, so I agree with most analysis I read, that US$ is forming a major bottom.

So to summarize above, intermediate-term still a correction is possible.

A hollow red bar was formed again on the UUP chart, so UUP could rebound tomorrow which is not good for the stock market. By the way, the reversal effects of “hollow red bar” and “solid black bar” do not work for all stocks, so a back test is needed to determine if they’re effective or not. From the UUP chart, we can say, so far the “hollow red bar” worked OK in the past.

T2103 Zweig Breadth Thrust, overbought with negative divergence, so could mean a pullback in a short-term.

STEM.MR, one of the short-term models from www.sentimentrader.com also is overbought with negative divergence.

So to summarize above, plus CPCE <= 0.56 mentioned in After Bell Quick Summary, short-term the market could pullback. And after the pullback, the market may continue to a new high.

Anyway, if you do believe a short-term pullback, here are some “price up n days in a row while volume down n days in a row” short candidates, take a look if interested: FSYS,TAP,PWR,GPI,CA (for very short-term play only)