I’ve got conflicting signals again. With CPC < 0.8, not only a “firework” trading setup triggered but also it means we have 77% chances a green close tomorrow.

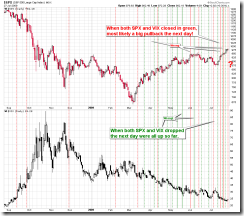

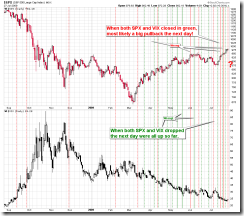

But we also have both SPX and VIX closed in green today which means 8 out of 11 times on the chart a red close tomorrow.

Personally, I’d give CPC signal more credit as VIX was wrong twice already recently.

Some comments for your info only:

Anonymous said... Thanks a lot. But, it seems that $CPCE closed around 0.53 based on the data here:

http://www.cboe.com/data/IntraDayVol.aspx

Can you kill your "firework"?

Cobra said... Hi, Anony, yes, I saw that. But this time I'll be very careful waiting until 7:30pm ET as stockcharts.com doesn't report exactly what I calculated from CBOE. Stockcharts.com should include the last 15min AH changes.

Disclaimer

The information contained on this website and from any communication related to the author’s blog and chartbook is for information purposes only. The chart analysis and the market recap do not hold out as providing any financial, legal, investment, or other advice. In addition, no suggestion or advice is offered regarding the nature, profitability, suitability, sustainability of any particular trading practice or investment strategy. The materials on this website do not constitute offer or advice and you should not rely on the information here to make or refrain from making any decision or take or refrain from taking any action. It is up to the visitors to make their own decisions, or to consult with a registered professional financial advisor.

This websites provides third-party websites for your convenience but the author does not endorse, approve, or certify the information on other websites, nor does the author take responsibility for a part or all materials on the third-party websites which are not maintained by the author.

Cobra,

ReplyDeleteAre you going to look at Gann Cycle - tomorrow is 144th day from 6th March? Thus, it looks like that it will be an interesting day. Either tomorrow or Friday (144th day from March 9th) could be an interesting day. Any thoughts?

Thanks a lot. But, it seems that $CPCE closed around 0.53 based on the data here:

ReplyDeletehttp://www.cboe.com/data/IntraDayVol.aspx

Can you kill your "firework"?

Vinod, I don't know. I know lots of EW still expect a final push up to maybe 993-1005 before any corrections.

ReplyDeleteHi, Anony, yes, I saw that. But this time I'll be very careful waiting until 7:30pm ET as stockcharts.com doesn't report exactly what I calculated from CBOE. Stockcharts.com should include the last 15min AH changes.

ReplyDeleteI feel the market is still very strong. It will probably be a green day tomorrow.

ReplyDeletefirework in the morning, wash-off in the afternoon, that will fit both.

ReplyDeleteThanks!

ReplyDeleteMr Cobra

ReplyDeleteHow about the JNK:TLT + $SPX plot. Looks like maybe a top today.

chart

http://tinyurl.com/n3ycff

Anony, you mean from candlestick pattern, JNK:TLT looks like a top?

ReplyDeleteCobra, In support of Tues being an UP day,...the Sentimentrader STEM.MR indicators for both NYSE and Nasdaq are firmly oversold. I was surprised to see this.

ReplyDeleteRegards, Jim P.

Jim, I wouldn't read too much into that as it counts Cum TICK, Price Oscillator, Up Issue/volume ratio, TRIN, VIX etc etc together. I suspect it's VIX who gets it to oversold level but Cum TICK and Price Oscillator are far from it. More over because CPCE reads only 0.54 today, so now I tend to believe a down day tomorrow.

ReplyDeleteJim

ReplyDeletealso, that model which I use for almost all my trading will be heavily influenced by how vertical the recent 10 days have been. So right now, since it is basically up everyday, it will start to get oversold on only marginal weakness. I can say from experience that at trend shifts to the downside after a very strong advance into a top, the model may become very oversold by even the first or second day down off the top. Not saying that will happen here, but be careful about thinking they are "solidly" oversold.

also, I have inquired with Jason before about this specific instance of the model touching to oversold when the market continues to make higher highs like now. I didn't save the email reply, and can't remember the exact criteria I asked him to test, but the take away was basically that it was not very bullish short-term in the few instances that it has occurred before.

Pete

st mk alchemy

good work as always, thanks! I loaded more short positions for tomorrow's play ....

ReplyDelete