Today the market made its first higher high in recently recent several months. Tomorrow the market may very likely pullback, at least in the morning. Considered that trend often goes from one extreme to another, however, the judgement for pullback may not be sufficient, so I would rather to buy dip than sell short. Why buy dip? Because all mid-term signals in 0.0.3 SPX Intermediate-term Trading Signals are buy. What kinds of dips are good to buy? See 8.1.1 Buyable Pullback Rule. If tomorrow pullback happens and is not substantial, you may refer to conditions set in chart 8.1.1. I would like to emphasis that you should do your own due diligence after referring to the chart, instead of buying dip blindly.

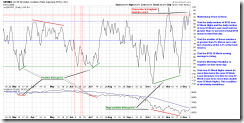

1.0.3 S&P 500 SPDRs (SPY 30 min). The good news is the neck line of the head and shoulders bottom broke out, which means this pattern is confirmed, and this is bullish. Furthermore, the gap up today may have formed an island reversal pattern which is also bullish as long as today's gap isn't filled in the short term. The bad news is the RSI is oversold, which is fairly accurate on 30-min chart.

1.0.4 S&P 500 SPDRs (SPY 15 min), 1.1.6 PowerShares QQQ Trust (QQQQ 15 min). MACD and RSI show negative divergence. The ChiOsc indicator on QQQQ is negative divergence, while it doesn't on SPY, so QQQQ is more likely to have a pullback tomorrow.

2.4.4 NYSE McClellan Oscillator. This is the worst signal for bulls -- NYMO is overbought, and this is the third highest on the record of StockCharts. Again, if under normal condition, the market is due for pullback. However I am not sure if this level is extreme enough under the current market condition. By the way, NYAD 10-day moving average on 0.0.3 SPX Intermediate-term Trading Signals is also very high which means overbought. Actually an article claims that such an overbought means bullish mid-term outlook (http://www.tradersnarrative.com/market-internals-overbought-but-room-to-run-2123.html). There have been 13 times when the 10-day average of the ratio has been 63% or greater, and today’s reading was 79% or higher. A month later, the S&P 500 was positive all 13 times, averaging +4.8%. Three months later, it was still 13-for-13, but the average return climbed to +8.6%.

1.5.0 Shanghai Stock Exchange Composite Index (Daily). The mainland China stock market broke out. Although RSI shows overbought, it is a good chance to buy in theoretically, and the target is 2333.

0 comments:

Post a Comment