| Trend | Momentum | Comments - Sample for using the trend table. Warning: This is NOT a trading recommendation! | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Up | Neutral | According to $NYA50R, the market might be topped. |

| Short-term | Up | Neutral |

| Report Focused On | Buyable dip or the market topped? |

| Today’s Summary | Still expect the SPY’s 5th gap to be filled soon. Don’t chase high if Monday is up again. |

Nothing new today, 5 unfilled gaps on SPY and lots of negative divergences are still concerns to me, so I won’t add long positions at this level. Either bulls or bears have no clear edge on Monday. Should the market gap up on Monday, however, I doubt if the 6th gap could still hold, therefore probably bears are safe at the moment.

The biggest edge of bulls on Monday is the seasonality from www.sentimentrader.com, the 2nd trading day is statistically the most bullish trading day in May.

OK, bears seem to have a lot of edge now. But don’t forget the trend table, both intermediate-term and short term are still up. One should be extremely cautious while trading against the trend.

1.0.2 S&P 500 SPDRs (SPY 60 min), this looks very bearish to me. I still think that before the 5th gap gets filled, bears have nothing to worry about.

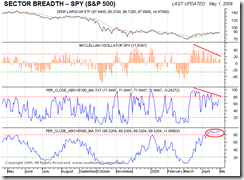

0.0.2 SPY Short-term Trading Signals, many negative divergences favor the odd of downside movement. Especially if considering the rally since Apr 20th as an up swing, it looks like that bulls just get back where they were before the Apr 20th, so they are not, at least as strong as before.

0.0.3 SPX Intermediate-term Trading Signals. Note the contraction of the BB width at the bottom of the chart. Something is going to happen, either big up or down. I bet on the downside because overbought plus negative divergences, so it’s hard to believe the market could go up substantially.

SPY breadth from www.sentimentrader.com.

T2103 from Telechart, Zweig Breadth Thrust, now you should feel more confident about the accuracy of the overbought of this indicator. Maybe the overbought on Friday is not at extreme, however if the market goes up on Monday, it will very likely turn around on Tuesday. Again, don’t chase high if the market goes up on Monday.

T2121 from Telechart, 13 Week New High/Low Ratio, overbought must be corrected.

1.1.1 Nasdaq Composite (Weekly), it is very impressive that COMPQ has rallied for 8 consecutive weeks. Now RSI has reached a critical level.

2.8.2 Normalized CPCI:CPCE, remind you that CPCI spikes up again.

5.0.1 S&P Sector SPDRs. Friday rally was led by the breakout in the energy sector, while the financials sector was lagging behind.

Now take a look at the following inversed correlation between XLE and XLF. If the breakout of XLE on Friday means XLE starts to outperform, this will be bearish to the overall stock market because SPX tends to follow XLF.

7.4.0 S&P/TSX Composite Index (Daily), 7.4.1 S&P/TSX Composite Index (Weekly). The daily MACD and weekly STO on the Canadian market index have given a sell signal. However I think bears should not rush in at the moment because the possibility of energy sector outperform is actually a good news to TSX which is dominated by energy.

Cobra, these next days nothing much will happen: the results of the stress tests will be released next Thursday after the close of the markets. Until then we can attend to chores such as hedging positions and mowing the lawn...

ReplyDeleteWell, you just reminded me that I have to patch my lawn again today which I've been trying not to think about it.

ReplyDeleteGlad you mentioned the XLE and energy, I've watched the OIH breakout and Friday showed strength in both Nat Gas and the coal names. I won't start any new energy longs with the $Bpener in the 80s nearing a good sell point.

ReplyDeleteMany of these "Ascending" people are looking at... seem suspect...

ReplyDeleteExcept it could be confirmation bias on my end..

LOL

makes sense why they delayed the stress tests until the 5th trading day of month so to better assist a statistically negative trading day perhaps...thanks Cobra.

ReplyDeleteThanks cobra nice work.

ReplyDeleteSPX - Different I don`t see why

Many sites and blogs, traders write and speak that this moviment it`s different that we have seen in the past.

It`s just the same for me. Until now I don`t see any difference.

See the charts and you will understand better what I want to saw.

Can see the number of weeks of spx move higher. And the number of points between de low and the top.

http://rounderstrader.blogspot.com/2009/05/spx-different-i-dont-see-why.html

DAX - Where they want to go???

Open the chart. Will be different this time? Why?

Next significant decline will start next week or secound week of May.

http://rounderstrader.blogspot.com/2009/05/dax-where-they-want-to-go.html

Carlos, the rally feeds on all the negative news in the media and everybody remaining doubtful. Too many investors and traders are bearish, so there will be no big decline next week. I presume most of the bullish action is from shorts being squeezed. We all know the feeling, it's like the CIA giving you the waterboard treatment...

ReplyDeleteHey Cobra,

ReplyDeleteI have posted in a while but wanted to say thank you for the daily analysis.

uempel,

ReplyDeleteyou are incorrect, shorts are very squeezed out already, lowest levels in many years. The gains are from mutual funds and institutions chasing highs after they sold low. Many investors are reacting to the ECRI recession end call:

http://www.businesscycle.com/

Eventually, there will be a selloff and a higher low, but who knows when (as it's overdue).

Anonymous 7:49 PM, many thanks for the link.

ReplyDeleteWhat a fricking train today! SPX over 900.

ReplyDeleteCobra,

ReplyDeleteNo offence, but all these hard work could not even predict an up day, may be you should restrategise...you can talk about negative divergence everyday but the market will keep going up....the use of known charts and indicators would not get you very far.. you need innovative analyses and that do not come easy...

2c

2cents, thanks for enlightening me, but frankly, if I can predict everyday precisely, I won't be here writing this blog anymore, instead I would now sun bath somewhere...

ReplyDelete2cents, what's the best option? Fundamentals aren't working. Technicals aren't working. The only thing that is working is Jim Cramer. This guy declared the depression was over and never looked back. Even with the markets surging, he hasn't even once suggested to take money off the table. Who does that?

ReplyDeleteNow anybody with a brain would start to bank profits and yet this market has not taken a breather. The behavior feels so unnatural. Therefore, please enlighten us with your suggestions. Thanks.

Cobra, and Anonymous,

ReplyDeleteTA Charts and fundamentals are for long term investors only. If you trade options you have to completely retrain yourself. It is entirely natural for the market to run up. If you trade options on negative divergence you will be bankrupt. Using statistical analysis I can tell what's going to happen the next day with 90% confidence. But I cannot disclose my years of work and testing here. Cobra is by far the best free site there is, but I just cannot pull the trigger based on his information.

2c

2cents, thanks again. But from my report, I don't recall I encourage any short sellings. Instead I kept saying that shorting is against the trend and must be taken cautiously. And yes, I didn't predict a huge up day today, but I think I did give enough statistics about today. So I mean, I may not have your ability to predict the market well but I don't see how wrong I was in those days. Anyway, don't get me wrong, I really appreciate you pointing out that I'm not good at predicting the market comparing for all those hard work spent. I sure will remember that and keep improving myself. Thanks again.

ReplyDeleteCobra: Thank you for all your hard work. On behalf of the rest of us, I apologize for the 2cents' rudeness.

ReplyDeletestill too many bears, Sorry guys... Mother market still has to blow you out!

ReplyDeleteI'm not trying to be rude... but given enough time, we are close...

Teresa says, "somewhere from a bit higher to 950"... those are the Jan highs.

I would suggest we may even get a false breakout, above there intra-day. Maybe we will run out of momentum before.

I'm still looking to sell it, but still higher.

That break-out was legit and we had to watch out for it. and 950 is still quite a distance. I do have some 920 and 940 targets... but to say it is like a shotgun.

Mr Anonymous

ReplyDeletethis is the truth and not rudeness, if you cannot take this you should not be in the market..btw being anonymous shows that you are so timid to be forthright

2c