| Trend | Momentum | Comments - Sample for using the trend table. Warning: This is NOT a trading recommendation! | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Up | Overbought | According to $NYA50R, market might be topped. |

| Short-term | Up | Neutral* |

| Report Focused On | Buyable dip or the market topped? |

| Today’s Summary | No idea about tomorrow just a few speculations about potential further pullback. |

Up or down, no idea about tomorrow. The pullback today has corrected all the short-term overbought signals so it’s actually good for bulls. Now the question is whether the pullback could last for a few days? I don’t have any solid proof but two (perhaps wishful) speculations, so simply read them for fun.

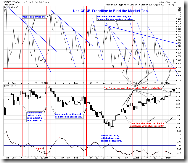

0.0.2 SPY Short-term Trading Signals, this is the 3rd reversal day so far, while the previous 2, as illustrated on the chart failed to reverse the trend, so the question is: Is the 3rd time the charm?

From the chart bellow, we can see SPY had 2 BIG down gaps before and got filled right on the same day which strongly expressed its unwillingness to go down and thereafter SPY kept going up without virtually any pullback. Now we had 2 BIG up gaps and got filled right on the same day which, at least to me, strongly expressed its unwillingness to go up. If indeed the market tends to be symmetrical (like we always see from the mother nature), does this mean that it would pullback exactly the same amount?

So the conclusion is that maybe bears still have hopes, especially because SPY has 6 unfilled gaps and for the recent 2 days the SPY has showed us its unwillingness to hold the 7th gap. So it seems pretty reasonable to expect that at least SPY to fill its 6th gap before going further up. Hmm, a question for you: if the market gaps up again tomorrow, do you still expect that gap to be filled on the same day? The tough part is here: That’ll be the 3rd gap up open and because the 3rd time is the charm, so... Well, I don’t know. LOL

A few interesting charts bellow, just have a quick look.

2.8.0 CBOE Options Equity Put/Call Ratio, this argues a short-term top. But since it’s been wrong 2 times recently, I’m not sure if it tells the truth or not.

3.4.1 United States Oil Fund, LP (USO Daily), STO plus the black bar which has very high chances of being a reversal pattern, so oil might pullback.

5.3.0 Financials Select Sector SPDR (XLF Daily), I see multiple resistances ahead.

To all who feel betrayed...

ReplyDeleteAs I lay here, mortally wounded from the 2 month battle between the bears and the bulls, I realize that the bulls that I have been fighting is actually an Evil Hunter, dressed up in a bull suit, that has been playing both sides for years.

This evil hunter, better know as the crooked banks and crooked leaders. You know the ones who have staged this whole rally to kill us bears.

They hide in the bushes and shoot at both bears and bulls when the season is open. The secret is knowing which season your in? Only the evil hunters know that. If only the bulls and bears would team up and destroy the hunters... Wishful thinking, but not reality.

The bulls and bears have been fighting each other for too long to remember how it all started.

My only hope is that enough of my fellow bears wake up from hibernation and drive these bulls into the ground. Otherwise, my death is as good as sealed, and will happen next Friday.

Just like the one-eyed Cyclops that gave up one of his eyes to see into the future, only to be tricked by only seeing his time of death, I too gave up one eye for higher returns, only to be tricked by the evil hunters dressed up as bulls.

Not even the real bulls knew they would so easily destroy the bears in the last 2 months. They simply were glad to have the mighty evil hunters (dressed up as bulls), on their side.

But, they forgot to ask the evil hunter why they were there, and what they wanted in return. Now, secretly, the evil hunters are taking off their bull suits, and retreating to the bushes while they await for the sleeping bears to wake up.

The real bulls are about to get so angry bears charging at them with vengeances. The evil hunters will sit back and watch as the bulls get stomped on.

If this sounds like a Hollywood movie... well, not exactly. More like a reality show. Where the real bulls are poor Joe Schmooze, and his 401k plan, the bears are the amateur traders, and the evil hunters are of course the big banks that are preparing to steal other $74.6 Billion from both bears and bulls.

So, who's going to win this epic battle? Neither Bear nor Bull... only the evil hunters win in this reality show!

Dan Black

Keep up the hard work Cobra... Insanity won't last forever!

why is it so suprising that a bear market rally can extend up to the 200 MA??

ReplyDeletehey i got burned anticipating a top too, but i ain't whining about it.

i've been trading a long time and i am kickingmyself a little for not remembering marty zweig's old rules of 1) don't fight the fed(and this is the mother of all fed actions), and 2) don't fight the tape( and the tape has been strong)

the failure of our neat little TA rule that we got used to using successfully tells me that too many little traders got to using them and so they actually fed the melt up....that's how it works...if too many people run over to one side of the ship, the ship capsizes

just keep diversified, don't bet it all on one horse, then you will live to trade another day after this small trader shakeout is over

all markets shake out players when there get to be too many on one side of the trade

look at crude oil, what a mother of a shake-out....all because to many speculators were on one side of the trade

sell some stuff on ebay and get your cash back up and be ready to fight again

very few are successfully at trading the stock market...don't quit your day job. The amount of emotional you have towards the stock market is and will be your downfall.

ReplyDeleteCobra, you are doing just fine. Only two gaps will be filled in this leg down, the rest in about a month.

ReplyDeleteMarket will crash on May 12, after that we're heading back to lower then 6.5k. I wouldn't be worried about it if you are bearish on the market, the ride up was hurtful but the market is done for. You're doing a good job Cobra.

ReplyDeleteCobra,

ReplyDeleteDo you have any stats on

unemployment no. gap fills...?

Thanks

2c

2cents, I tried but couldn't find any statistics.

ReplyDeleteHi, Dan, thanks for posting. I'll sure keep up my "blog business" as long as the market always can leave me something to "speculate" instead of saying "overbought" everyday. Cheers!

ReplyDeleteJim, this round make me realize (again for many times) that my way of keeping 2 different fund trading on different method is very important, one is simply following the trend following indicator and another is trading on momentum indicator. Under situlation like this, momentum indicator doesn't work well but the trend following indicator will compensate that problem. Thanks Jim and good luck!

ReplyDeleteWinning strategy has been: Don't let anything shake you off the bull...JUST STAY LONG NO MATTER WHAT.

ReplyDeleteJim, you are absolutely right… However, I did assume that we would get to the 200 dma, just not without a decent pullback. I think many people were waiting for the ABC to form, so they could get long on the way up. But, it never happened? That’s what frustrated me… and probably many other traders.

ReplyDeleteI'm just amateur trader who quietly reads all the blogs trying to piece together the puzzle of how to make it work for me successfully. But, it seems lately I have been on the wrong side of the boat, and will be tossed overboard next week.

However, bears can swim... and if it takes this bear awhile of treading water until the next ship passes by, then I'll be ready sneak aboard as she passes by. I might miss the summer rally, but I'll be recharged and ready for the fall collapse.

Just dumb mistakes made by this bear because of greed. As the old saying goes... "A bird in the hand is worth 2 in the bush". I'm more like the fox who caught the bird, but while walking across the bridge he looks down at the water and sees another bird. Thinking he can easily catch the bird he opens his mouth to get it, and drops the bird already in his mouth into the water ending up with NO bird at all.

Thanks for the advice… it is now noted.

Dan Black

P.S. As for what Anonymous said...

"Don't let anything shake you off the bull...JUST STAY LONG NO MATTER WHAT."

I'll need some mighty powerful Viagra to go long at these levels!

Dan, don't feel frustrated, being sometimes wrong is part of the trading. The most important thing is to keep alive (i.e. manage your risks). Sincerely wish you good luck!

ReplyDeleteWhy don't you guys just try looking at the last 3 months, draw a channel, and play it? : P

ReplyDeleteCobra's analysis can sure help with better entry and exit points (and possible major turns), but IMO you guys are over thinking it.

Amen, Brother Dave.

ReplyDelete