| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

*DTFMS = Dual Time Frame Momentum Strategy. The signal is given when both weekly and daily STO have the same buy/sell signals.

SEASONALITY: THE LAST TRADING WEEK OF MONTH WAS BEARISH SINCE AUG 2009

The next week is the last trading week in May (Market closed on 05/31 Memorial Day), according to the chart 6.5.2c Week Seasonality Watch, it’s bearish since Aug 2009.

4.1.0 S&P 500 Large Cap Index (Weekly), weekly Stick Sandwich (Unlike common believes, Stick Sandwich means bearish continuation 62% of the times, it’s not a bullish reversal pattern), happens to support the seasonality above – bearish the next week.

6.5.2b Month Day Seasonality Watch, another seasonality next week is that the last 2 trading days of a month were generally bearish, since Aug 2009.

INTERMEDIATE-TERM: MAINTIAN PULLBACK TARGET AROUND 1008 TO 1019

Begin with the conclusion first:

- Chances of an intermediate term bottom are small, so maintain the pullback target around 1008 to 1019 (see 05/14 Market Recap for more details).

- Whether we’ll see a very very bullish Monday again is hard to say, so may need wait until the next Tuesday to see if indeed the market was bottomed. Right now, all I can say are I cannot exclude the possibility that we’ll see a huge short-term rebound.

- The Friday’s reversal has fulfilled the 05/19 to 05/22 time window forecast (see 05/07 Market Recap for more details). The next possible time window is 06/05 to 06/06. Whether it means a top or bottom, is hard to say now. If we see a follow through next week to prove indeed the Friday was a reversal day then the rebound could last to 06/06, while if the market resumes dropping the next week then the pullback could last to 06/06.

Why the chances of an intermediate term bottom are small? Take a look at the chart below. The main idea is a forward accelerating car cannot be reversed backward without reducing the forward speed first (well, physically it’s impossible at least on the planet earth), so I’ll keep the lower low and lower close ahead bearish signals in the table above.

6.4.1 Extreme NYADV Readings Watch, as mentioned in 05/20 Market Recap, the chart forecasts a SPX lower CLOSE ahead. Now take a closer look at the chart again, see blue cycles – strong bullish reversals were actually very common after a very strong down day, so if the Friday’s reversal indeed means a reversal is hard to say. At least in this chart, chances are not very good.

Why the next time window is 06/05 to 06/06? Multiple Gann Days plus 06/06 is 30 degree to the 05/06 /2010(I’m sure you still remember what happened on 05/06) and plus 06/06 is a Solar Term date which also is a very common turn date.

4.1.9 SPX Cycle Watch (Weekly), also argues the first week of June could be a turning week.

WARNING: If you don’t understand the true meaning of overbought/oversold, please skip the session below. Generally, you should try your best not to trade against the trend. Trading purely based on overbought/oversold while against the trend is lethal to the health of your account. Before going further, please make sure you understand how to use the table above.

SHORT-TERM: EXCEPT THE SEASONALITY, THE NEXT MONDAY DOES NOT HAVE MUCH BULLISH EDGE

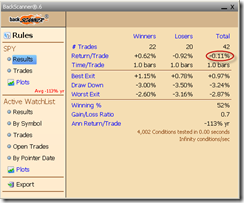

I assume that you’ve already seen the notification – SPY ST Model Cover Short Signal. Let me clear some misunderstandings first: The signal only says to cover the existing short position. The SPY ST Model is sill in SELL mode, in another word the strategy is still to sell the bounce. The chart below are past cases (blue bars) when SPY ST Model issued a cover short signal, as you can see clearly, it didn’t mean an absolute bottom.

0.1.0 SPY Short-term Trading Signals, and lots of other index daily charts, fits all 4 bottom calling conditions, so I must admit that the Friday’s reversal looks very promising. The key, of course is whether we’ll see a follow-through the next week.

Are we going to see a follow through the next week? Well, at least now it looks not very optimistic. Because firstly the seasonality mentioned above is not bull friendly. And the secondly, whether we’ll see a Monday follow-through still has two question marks:

On Friday, SPY rose 0.81% in the last 10 minutes, this actually is not a good sign, at least the past statistics Late-Day Market Surges says so. This could be an overreaction which means most likely a pullback the next day.

Also Friday is a Major Accumulation Day (NYSE Up Volume to NYSE Down Volume > 9), the statistics below shows buying at close on a Major Accumulation Day then selling the next day’s close doesn’t have much bullish edge.

The chart below shows more specific cases. The Friday’s Major Accumulation Day is right after the Thursday’s Major Distribution Day (NYSE Down Volume to NYSE Up Volume > 9). There’re only 4 cases in the past, all closed in red the next day and eventually the low is retested a few days later. Well, I know the cases are too few to mean anything, so for your info only.

So to summarize above, the Friday’s reversal revealed the light on the other side of the tunnel, but the question remains how far still needed to go before bulls can be completely out of the tunnel? 1.0.0 S&P 500 SPDRs (SPY 60 min) should provide some rough ideas – lots of resistances ahead: 05/07 low, price channel, multiple Fib confluences area and long term MMA (pink), etc etc. So to bull or to bear, we’ll have to wait and see.