| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

SEASONALITY: NO UPDATE

SPX TIME AND TARGET ANALYSIS: THE PULLBACK COULD LAST TO 05/23

See 05/10 Market Recap for more details.

INTERMEDIATE-TERM: 05/06 LOW WILL BE BROKEN BUT NO EVIDENCE SAYS THIS IS A START OF A NEW BEAR MARKET

See 05/07 Market Recap for more details.

WARNING: If you don’t understand the true meaning of overbought/oversold, please skip the session below. Generally, you should try your best not to trade against the trend. Trading purely based on overbought/oversold while against the trend is lethal to the health of your account. Before going further, please make sure you understand how to use the table above.

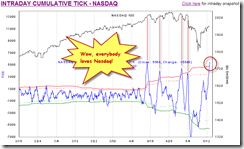

SHORT-TERM: NASDAQ CUMULATIVE TICK SKYROECTED AGAIN

Still no conclusion today. As mentioned yesterday, the signals in the table above argue that the market could have bottomed but the chart pattern and time do not conform. To be fair, the chart below listed all the 1 leg down cases since the March 2009. You can see it’s common to take 8 trading days to complete a down leg, so it’s not entirely impossible that the pullback was over (since it lasted 8 trading days too). Although comparing with all the previous pullbacks, the one we had recently is much much bigger, which should be very rare to have only 1 down leg. Plus we haven’t seen the real test yet which should be around SPX 1181 to 1186 area. So still TEMPORARILY maintain the forecast for expecting a 2nd leg down.

As mentioned in today’s After Bell Quick Summary, I’ll WOW again tonight. The last 4 time I WOW-ed were in 05/03 Market Recap, 04/29 Market Recap, 04/20 Market Recap and 04/14 Market Recap. See below for today’s WOW. Nasdaq Intraday Cumulative Tick extremely high means nobody sell, so besides nobody, ‘the rest” simply buy and buy and buy, which is a little bit too bullish. However, since this kind of WOW becomes so frequent recently, I’m not sure if it simply means a change in trading characters in Nasdaq, therefore we shouldn’t read too much into it, so for fun only perhaps.