| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

*Please make sure you understand how to use the table above. The main purpose of this report is to provide information so contradictory signals are always presented.

SEASONALITY: BEARISH MONDAY TO WEDNESDAY, BULLISH THURSDAY AND FRIDAY

See 06/25 Market Recap for more details.

Correct an error here, the seasonality chart posted yesterday was wrong, here’s the real July seasonality chart.

INTERMEDIATE-TERM: THE LOW TODAY MAY NOT BE THE LOW

0.1.0 SPY Short-term Trading Signals, the Hammer formed today looks very encouraging which rises a hope that the low might be in.

However, I believe the low today may not be the low.

The main reason is for a huge correction it usually consists of 2 down legs, while from the chart below, so far there’s only 1 leg down, so not over yet.

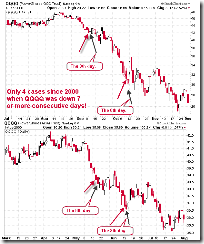

0.1.2 QQQQ Short-term Trading Signals, QQQQ down 9 days in a row, again for a downward push this huge it should be very rare to rally at the very first rebound attempt. So let me remind you again, in the chart below, what happened when QQQQ down more than 7 days in a row in the past.

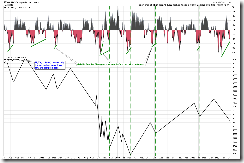

6.3.2a Major Distribution Day Watch, the trick about the Major Distribution Day (NYSE Down Volume to NYSE Up Volume Ratio >= 9) is most likely a green day the next day. Well, what if a red day the next day instead of a common green day? What if the next next day is still a red day? The chart below shows what happened thereafter. Looks to me, a short-term rebound maybe but after that there’ll be more on the downside.

The chart below is just a follow up for 06/29 Market Recap since some people are asking: Now the very basic bottom condition – NYMO positive divergence has finally been met. Well, again the lesson learnt here is we should try our best not to think that MAYBE THIS TIME IS DIFFERENT!

SHORT-TERM: EXPECT REBOUND SOON, TIME TARGET COULD BE AROUND 07/07 TO 07/11

We may see some kind of rebound in the short-term. Actually, the blah blah mentioned in the intermediate-term session above has already implied that there’ll be a short-term rebound (otherwise there won’t be the 2nd leg down, will it?). Also in today’s After Bell Quick Summary, I mentioned when both VIX and SPX are red, there’re 76% chances a green the next day. And here are the other 2 reasons:

0.1.0 SPY Short-term Trading Signals, SPY down 4 days in a row, buy at close today sell at close tomorrow since year 2000, you have 80% chances.

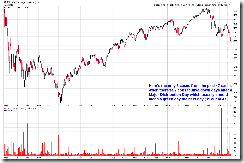

See red cycles, both the previous 2 pullbacks lasted 8 trading day while the current pullback happens on its 8th trading day today, so very likely the pullback is over or very close to be over. See green lines, because the past 3 rebounds lasted from 5 to 9 trading days, so also likely, the rebound we’re going to have will last 5 to 9 trading days. Considering all the time factors listed in the table above, the Gann Day (07/07 to 07/11), the New Moon (07/11) and the Solar Term date (07/07), so very likely the rebound could last to around 07/07 to 07/11. By the way, should the current pullback size equal or similar to the previous 2 times, then the pullback target should be around 998.44 to 977.22, see red marks below. So far we’re still far away those red marks, so there’s a chance we may see more pullbacks tomorrow or the next week. I think such a chance is a little bit low though, because the blue Fib confluences area (see 4.1.0 S&P 500 Large Cap Index (Weekly) for how I get the confluences area) is a strong support area and today SPX rebounded strongly right on that area.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

*DTFMS = Dual Time Frame Momentum Strategy. The signal is given when both weekly and daily STO have the same buy/sell signals. Use it as a filter, don’t trade directly.

| TREND | *DTFMS | COMMENT – *New update. Click BLUE to see chart if link is not provided. | |

| QQQQ | *DOWN | ChiOsc a little too low. | |

| IWM | DOWN | SELL | Ascending Broadening Wedge breakdown, target $54.97. |

| CHINA | DOWN | ||

| EMERGING | UP | SELL | |

| EUROPEAN | UP | ||

| CANADA | DOWN | SELL | |

| BOND | UP | Breakout but ChiOsc is way too high now. | |

| EURO | *UP | *BUY | |

| GOLD | UP | *SELL | 4.3.0 Gold Trust Shares (GLD Weekly): Head and Shoulders Bottom, target $129.99. |

| GDX | UP | *SELL | 4.3.1 Market Vectors Gold Miners (GDX Weekly): GDX:$SPX is too high. |

| OIL | *DOWN | *SELL | |

| ENERGY | DOWN | ChiOsc a little too low. | |

| FINANCIALS | DOWN | ||

| REITS | UP | SELL | 4.4.3 Real Estate iShares (IYR Weekly): Pay attention to XHB weakness! |

| MATERIALS | DOWN | SELL |