Summary:

CPCE chart argues for an intermediate-term top.

Suspect that SPX 878 will be tested.

Expect a rebound at least tomorrow morning.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Down | Neutral | |

| Short-term | Down | Neutral |

First of all, please do remember to take a look at 0.0.0 Signal Watch and Daily Highlights everyday, which now is a little bit oversold short-term, and just a little distance from the “extreme”, therefore if the market drops again tomorrow, bears better take some chips out of the table.

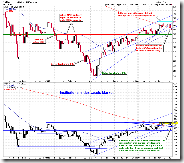

2.8.0 SPX:CPCE, trend line was broken AGAIN which means the market might be topped. This signal never went wrong before. But since the March rally, the signal was wrong twice. I’ve put these wrong signals on the chart so that we can see that the previous 2 times the trend line wasn’t broken in a decisive way especially the next day the CPCE went directly bellow the trend line. So accordingly, I think we need see CPCE rising more tomorrow to be fully convinced that indeed this time is different.

1.0.1 Institutional Index (Daily), take a look at SPX chart bellow first, if it could bounce sharply tomorrow, then the 2 days pullback we had, can be considered as a back test to the breakout point which is bullish. But the institutional index above already broken bellow MA200 today, so if indeed institutional index leads the market, then soon or later the SPX will breakdown bellow the MA200. Therefore accordingly, I suspect that this round of pullback may at least test the SPX 878.

Tomorrow, I expect a rebound at least in the morning. (Well, it doesn’t mean that the market won’t open with a down gap and also I’m not sure if the market can eventually close in green.) The reasons:

Short-term models from www.sentimentrader.com.

1.0.4 S&P 500 SPDRs (SPY 15 min), Bullish Falling Wedge plus lots of positive divergences.

2.0.0 Volatility Index (Daily), VIX ENV overbought, so VIX could pullback which is good for the market. If however the VIX keeps rising tomorrow, then it will bump into some strong resistances not far away above which I don’t think it’ll pass on the very first attempt. Also, 2.4.4 NYSE McClellan Oscillator is very close to an oversold level now, if the market drops again tomorrow then it will be oversold. From my experiences the NYMO oversold is quite accurate. These are 2 major reasons that I mentioned at the very beginning of this report that if the marked drops again tomorrow, bears better take some profits.

Hi Cobra,

ReplyDeleteTks again for the nice job!!!

Based on your observations, I started to use some index that are very accurate. My favorite on intraday trading is SPX:CPC. For example yesterday and today it did not move the trend besides several swings that we had in the market (I use mainly MACD 13-34-8 on 15 min charts)

Currently Stockcharts has 03 Option ratios: CPC, CPCE and CPCI. What are the main differences between them? For example if we compare today's SPX:CPC and SPC:CPCE, the trend is different. Why?

Thanks

CPCE is equity only put call ratio.

ReplyDeleteCPCI is index only put call ratio.

CPC is equity + index put call ratio, so called total put call ratio.

CPCI usually represents big players.

CPCE usually represents small players.

Well, not very accurate, but just simply think this way.

Sounds good!!!! Tks again

ReplyDeleteCobra, Mortgage Applications dropped 16% for week ending 12June2009. Another double digit drop. The housing bubble is continuing is massive collapse and will take the market with it and all of it's green shoots in the resulting landslide....

ReplyDelete-Michael

Hi,

ReplyDeleteWhere can I look up these charts CPC, CPCE etc..Are these free or do I have to subscribe.

For CPCE/CPC/CPCI I get it form stockcharts.com.

ReplyDeleteYou can also get it from here: http://www.cboe.com/data/IntraDayVol.aspx.

And since my chart book is publicly listed, you can always get it from my chart book: http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID2393449&cmd=show[s168797393]&disp=P, just there's a problem with the data feed, the intraday CPCE readings are incorrect until 7:30pm ET.

Cobra, just confirming that you view the CPC and CPCE trendline break as legitimate even though it is OE week? Thanks.

ReplyDeleteIf today closes right here then CPCE trend line broken is offical. I don't care about OE or not.

ReplyDeleteToday's 15 min SPX:CPC chart is showing a bullish crossing at MACD (13,34,8). I bet that tomorrow we will have some pop. However I "feel" that huge ralies time is over. So, nothing big, only a relief for this downturn

ReplyDeleteSorry, 30 Min, the most accurate from my back tests (not 15 Min)

ReplyDeleteCobra,

ReplyDeleteOn your $NYMO graph you make a reference to the Hindenburg Omen.

Are you seeing one, or is that just a reference for your own use?

Ajvs, thanks!

ReplyDeleteJohn, I don't see Hindenburg Omen yet (last year, yes). It's just a reference.