Summary:

Bears have 4 days to breakdown bellow SPX 888 to prove themselves.

A VIX sell signal was triggered.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Down | Neutral | |

| Short-term | Up | Neutral |

The drop today doesn’t say anything to me. Still it looks like a consolidation pattern on the daily chart therefore it could go either up or down. Let’s wait to see how the market unfolds tomorrow. In the After Bell Quick Summary, I mentioned that if there’s a rebound tomorrow then QQQQ has better chances.

7.1.0 Use n vs n Rule to Identify a Trend Change, bear sees some hopes finally. Now it has 4 days to prove itself.

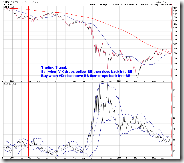

7.3.4 VIX Trading Signals, VIX rose from under BB lower boundary into BB, triggering a well known short-term sell signal. From below chart we can see that the signals worked so far so good ever since the 2008 bear market.

Cobra, thanks for all your hard work on this site, Was the fireworks scenario canceled because of the done market today, or could it still happen tommorow or the next day??

ReplyDeleteThe firework still is on until one day the market has a big gap down.

ReplyDeletelots of talk about the 200d sma. do you ever post the % off of the 200d high.

ReplyDeleteYou mean this: http://stockcharts.com/def/servlet/Favorites.CServlet?obj=ID2393449&cmd=show[s152595461]&disp=P

ReplyDelete