Summary:

Watch the possible breakout of the 9/23 high.

Still could be very close to a short-term top.

| TREND | MOMENTUM | COMMENT - Sample for using the trend table. | ||

| Long-term | Up | |||

| Intermediate | Down | Neutral | ||

| Short-term | Up | Neutral | ||

| SETUP | DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| Index ST Model I | *Watch Breakout | Stopped out long with gain on 10/01. No position held now. | ||

| Index ST Model II | Stopped out short flat on 10/08. No position held now. | |||

| VIX ENV | 10/08 Low | Long on 10/06. | ||

| Reversal Bar | 10/09 | *Adjust stop loss | 10/06 Low | Long on 10/05. |

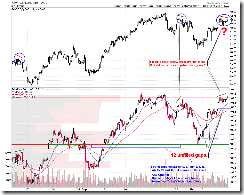

INTERMEDIATE-TERM: WATCH THE POSSIBLE BREAKOUT OF THE 9/23 HIGH

1.0.8 SPX Cycle Watch (Weekly), in the last weekend’s report, I mentioned that Elliott Wave International argued that the catastrophic wave 3 down had started for 2 reasons:

- Four of three resistance.

- The wave 1 down lasted for 74 weeks and the rebound has lasted 28 weeks which is right at the Fib 38.2 of the previous 74 weeks.

From the market action this week we can see if SPX could breakout above its 9/23 high at 1080 then definitely it’s not the wave 3. Instead it still could be A = C which means the target could be around 1159. And the time could be on my next 22 week cycle which happens to be the Fib 50 of the previous 74 weeks.

Personally, I’m not sure about the intermediate-term direction now. My bottom line:

- Breakout above 9/32 high then Index ST Model I will give buy signal. As long as it’s not a reversal day, i.e. Close > Open and not a Doji, then I’ll follow this signal.

- 1.2.1 Dow Theory: Averages Must Confirm, since most breadth signals are still overbought plus TRAN has yet confirmed the INDU’s new high, so I don’t really believe that 1159 target, instead I still think a 10% correction is possible.

5.0.5 S&P Sector Bullish Percent Index I (Weekly), 5.0.6 S&P Sector Bullish Percent Index II (Weekly), take a look if you have time. Quite a few sectors are still overbought especially the Tech sector which is way too overbought.

SHORT-TERM: MAINTIAN THE CONSOLIDATION THEN PULLBACK FORECAST

Short-term, I’m still expecting a pullback to at least fill the 10/8 SPY’s 12th unfilled gap. Just I’m not sure which one come first: a new high or a pullback.

1.0.3 S&P 500 SPDRs (SPY 30 min), Symmetrical Triangle breakout, the text book target is $108. This means a new high first.

1.0.2 S&P 500 SPDRs (SPY 60 min), the SPY and QQQQ negative divergence may mean a pullback first. By the way, pay attention to the blue annotation box which lists all the past 8 unfilled gaps. You can see there’re usually one to two weeks between each unfilled gaps. While now we had 3 gaps on 10/5, 10/6 and 10/8, almost a gap each day. I think this is too much.

The bottom line: 1.1.3 QQQQ Short-term Trading Signals, one of the black bar’s 2 prophecies was realized on Friday so it’s reasonable to believe that the past pattern may still work which means we're very close to a short-term top. So still maintain the consolidation then pullback forecast.

INTERESTING CHARTS:

The following chart is from www.bespokepremium.com. Up all 5 days of week is a rare thing.

The following chart shows the only 4 cases since 2002 that the SPY up at least 4 days in row and on the last up day the Russell 3000 had more than 1600 stocks up on decreased volume.