Summary:

A follow-through is needed to confirm the short-term pullback.

| TREND | MOMENTUM | EMOTION | COMMENT - Sample for using the trend table. | |

| Long-term | Up | Disbelieve | ||

| Intermediate | Up | Neutral | No argue | NYSI not confirming the up trend. |

| Short-term | Up | Neutral | ||

| SPY SETUP | ENTRY DATE | INSTRUCTION | STOP LOSS | Mechanic trading signals for reference only. Back tested since 2002. |

| ST Model | 10/14 L | *Adjust Stop Loss | *10/08 Low | |

| Reversal Bar | 10/05 L | 10/16 Low | *Stopped out with gain. | |

| VIX ENV | 10/06 L | 10/19 Low | *Stopped out with gain. | |

| NYMO Sell | 10/21 S | *Short intraday | *10/21 High | Winning Rate: 59%, Gain/Loss Ratio: 4.9 Very risky trade but occasionally may catch the exact market top. |

INTERMEDIATE-TERM: NO UPDATE

SHORT-TERM: A FOLLOW THROUGH IS NEEDED TO CONFIRM A SHORT-TERM PULLBACK

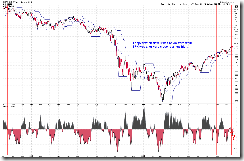

The bottom line, the sharp sell off before close may mean nothing if we don’t see a follow-through tomorrow. 1.0.3 S&P 500 SPDRs (SPY 30 min), 1.1.5 PowerShares QQQ Trust (QQQQ 30 min), both stopped right at an important support and have met the minimum Fib 23.6 retracement target, so there’re possibilities that the pullback was over.

1.1.3 QQQQ Short-term Trading Signals, overall, I still expect more pullbacks, especially it doesn’t look like the QQQQ black bar’s prophecy has been realized. Just I’m not sure whether this “more pullback” has started or simply the market is still in a consolidation range (before pulling back). See blue cycles, these 2 possibilities are both possible. So again let’s see tomorrow.

1.0.9 SPX Cycle Watch (60 min), another cycle turn date is due tomorrow and right now it’s hard to say it means a turning up or down. And again let’s see tomorrow.

1.0.4 S&P 500 SPDRs (SPY 15 min), this chart is “bull friendly”. ChiOsc is way too low, so there’s a chance that we’ll see a rebound at least tomorrow morning.

3.1.2 PowerShares DB US Dollar Index Bullish Fund (UUP 30 min), lots of positive divergences, so US$ could rebound anytime which is “bear friendly”.

INTERESTING CHARTS:

6.4.0 SPX and NYMO Divergence Watch, I’ve mentioned this setup in the weekend report. The sell signal was confirmed today. Again, it’s a risky trade, so the stop loss is very tight, please see trend table above.

2.0.0 Volatility Index (Daily), VIX dropped out of its ENV then rose back into it, this is a “sell short” signal. Just my back test results aren’t good for this setup if the intermediate-term is up, so I won’t read too much into this. Just mention it here for your references only.