| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SEASONALITY: NO UPDATE

INTERMEDIATE-TERM: STATISTICS ARE BEARISH

Whether the intermediate-term correction has began, all I can say are:

- Statistically, the following few weeks are bearish.

- All the long-term, intermediate-term and short-term trend indicators/model in the table above are in sell mode.

Now let’s take a look at statistics:

In 08/13 Market Recap, I mentioned the weekly Bearish Engulfing most likely means bearish week 2, week 3 and week 4. The next week is week 2.

T2105 reached a new high again on Friday. The main logic of the T2105 is similar to Hindenburg Omen, when too many new highs and new lows reached at the same time, it represents an internal inconsistency therefore is a bearish sign. I saw some comments in this blog saying that because there’re too many fixed income ETFs nowadays, so Hindenburg Omen is useless now (also see Know Your Indicators: Hindenburg Omen). Personally, I do not think it’s useless because at the time when Hindenburg Omen cried in 2007 and 2008, the fixed income ETFs were not as less as that of now.

Below are 2 simple back tests for T2105.

Since it’s not very easy to do T2105 back test, so I also posted the MACD(10, 200, 1) visual back test below. If interested, check what happened thereafter when T2105 was very high (not necessarily hit the 100 day high as one of my back test requires). By the way, orange cycles are all the 3 failed cases in the MACD(10, 200, 1) back test.

In 08/18 After Bell Quick Summary, I mentioned the ISEE Equities Only Index readings is extremely high while the ISEE Indices & ETFs Only Index readings is extremely low. The statistics below is from sentimentrader:

The difference between the two of 227 (256 - 29) is abnormally large. The table below highlights the S&P 500's performance going forward after other times the difference exceeded 225.

| Date | 1 Day Later | 1 Week Later | 2 Weeks Later | 1 Month Later |

| 01/05/06 | 0.8% | 1.1% | -1.1% | -0.6% |

| 02/28/06 | 0.9% | -0.2% | 1.5% | 1.4% |

| 03/22/06 | -0.2% | -0.3% | 0.5% | 0.6% |

| 04/06/06 | -1.0% | -1.7% | 0.2% | 1.1% |

| 11/09/06 | 0.0% | 1.6% | 1.6% | 2.6% |

| 05/07/07 | -0.1% | -0.3% | 1.1% | 0.6% |

| 06/01/07 | 0.0% | -2.0% | -0.7% | -1.5% |

| 06/04/07 | -0.4% | -1.8% | -0.8% | -1.1% |

| 06/15/07 | -0.1% | -1.7% | -1.7% | 1.1% |

| 06/22/07 | -0.5% | -0.1% | 1.6% | 0.5% |

| 07/05/07 | 0.5% | 1.5% | 1.9% | -5.5% |

| 07/10/07 | 0.7% | 2.5% | 0.3% | -0.7% |

| 07/12/07 | 0.3% | 0.4% | -4.1% | -6.3% |

| 10/08/07 | 0.9% | 0.0% | -2.9% | -1.9% |

| 10/29/07 | -0.7% | -2.7% | -6.8% | -4.5% |

| 04/15/10 | -1.6% | -0.2% | -0.4% | -6.1% |

| Average | 0.0% | -0.2% | -0.6% | -1.3% |

| % Positive | 50% | 31% | 50% | 44% |

In 08/19 Market Recap, I mentioned the 2nd Hindenburg Omen (confirming the 1st one). The statistics below is also from sentimentrader.

For what it's worth, the table below shows the S&P's performance after we got a second Hindenburg Omen signal within two weeks of the first one (I've excluded any that occurred on back-to-back sessions). The "Max Gain" and "Max Loss" columns show the S&P's best gain and worst loss during the next three months.

| 1 Week Later | 2 Week Later | 1 Month Later | 3 Months Later | Max Gain | Max Loss | # Days 'Til Low |

| 05/20/65 | -1.5% | -2.3% | -4.6% | -2.7% | 0.3% | -9.5% | 26 |

| 11/18/65 | -0.2% | -1.0% | -0.6% | 0.5% | 2.7% | -3.3% | 11 |

| 12/27/65 | 0.7% | 2.0% | 2.6% | -2.2% | 3.5% | -5.3% | 52 |

| 10/13/67 | -0.7% | -1.1% | -4.8% | -0.2% | 1.9% | -6.2% | 18 |

| 03/26/74 | -4.7% | -5.5% | -8.6% | -9.2% | 0.3% | -12.3% | 44 |

| 05/31/78 | 3.0% | 2.3% | -1.7% | 6.3% | 9.3% | -3.8% | 25 |

| 10/08/79 | -5.9% | -8.4% | -7.9% | -0.9% | 0.4% | -9.9% | 13 |

| 12/26/79 | -2.4% | 2.0% | 5.4% | -8.4% | 11.5% | -9.2% | 63 |

| 02/12/80 | -1.2% | -4.7% | -10.4% | -9.8% | 2.0% | -20.1% | 30 |

| 07/22/86 | -1.5% | -0.5% | 4.9% | -0.9% | 6.7% | -4.2% | 48 |

| 07/10/90 | 3.1% | -0.2% | -5.1% | -12.1% | 3.7% | -17.0% | 56 |

| 12/19/91 | 6.3% | 9.3% | 7.9% | 7.5% | 10.1% | - | - |

| 12/20/99 | 2.8% | -1.3% | 1.9% | 5.3% | 5.4% | -6.6% | 46 |

| 04/17/06 | 1.8% | 1.6% | 0.5% | -4.0% | 3.2% | -5.1% | 40 |

| 06/21/07 | -1.1% | 0.5% | 1.3% | -0.2% | 2.2% | -10.0% | 38 |

| 07/18/07 | -1.8% | -5.2% | -8.7% | -0.5% | 1.9% | -11.4% | 20 |

| 10/25/07 | -0.4% | -2.6% | -7.1% | -10.6% | 2.5% | -16.1% | 59 |

| Median | -0.7% | -1.0% | -1.7% | -0.9% | 2.7% | -9.2% | 39 |

| % Positive | 35% | 35% | 41% | 24% |

SHORT-TERM: QUALIFIED AS A BOTTOM

For short-term, all I can say are: the market is qualified as a bottom competitor but need final match to win the prize.

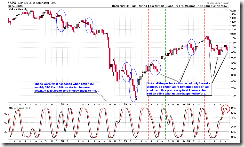

Comparing with the past, it’s clear the 2 leg down mini requirement has been met for a complete pullback, plus the NYMO positive divergence below, so it looks like a bottom, at least I cannot deny the possibility.

1.0.0 S&P 500 SPDRs (SPY 60 min), RSI positive divergence, Bullish Falling Wedge and C = 0.618 * A, in another word, a bottom is qualified.

Time wise, as I’ve been blah blah, the next important pivot date is around 08/23. From the current SPX position, it looks like the pivot date means a bottom. The next important pivot date, by the way, is around 08/26, so it could be the market rebound to 08/26 before the next leg down.

So to summarize above, the pattern, the price and the time are all met, therefore I cannot exclude the possibility that the market has already bottomed.

The last but not the least, let me explain why I think this just is a short-term bottom (if proven next week)? Because except all the bearish statistics mentioned in the intermediate-term session above, from the charts below we can see, if indeed there’s a rebound, it’s very unlikely to go very far.

6.2.3 VIX:VXV Trading Signals, still a little bit too low.

4.1.0 S&P 500 Large Cap Index (Weekly), see dashed red lines, the current NYSI weekly STO position at least means a choppy ahead, if not sell off huge. By the way, all the pullbacks since April so far down no more than 2 weeks, so if the same pattern repeats again, then we might see a green next week which can be seen as another proof that the market has bottomed.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | DTMFS | COMMENT – *New update. Click BLUE to see chart if link is not provided. | |

| QQQQ | UP | SELL | |

| IWM | UP | SELL | |

| CHINA | UP | *Head and Shoulders Bottom in the forming? | |

| EMERGING | UP | SELL | 4.1.6 iShares MSCI Emerging Markets (EEM Weekly): EEM to SPX ratio too high. |

| EUROPEAN | *DOWN | SELL | *Could be a breakdown of an important support. |

| CANADA | UP | ||

| BOND | UP | *4.2.0 20 Year Treasury Bond Fund iShares (TLT Weekly): Too far away from MA(200). | |

| EURO | *DOWN | SELL | |

| GOLD | UP | ||

| GDX | UP | *4.3.1 Market Vectors Gold Miners (GDX Weekly): GDX to SPX ratio too high. | |

| OIL | DOWN | ||

| ENERGY | DOWN | SELL | |

| FINANCIALS | DOWN | SELL | *4.4.2 Financials Select Sector SPDR (XLF Weekly): Head and Shoulders Top in the forming? |

| REITS | UP | SELL | 4.4.3 Real Estate iShares (IYR Weekly): Home builder is lagging, be careful. |

| MATERIALS | UP | SELL |