| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SEASONALITY: NO UPDATE

INTERMEDIATE-TERM: STATISTICS ARE BEARISH

See 08/20 Market Recap for more details.

SHORT-TERM: REBOUND STILL IS POSSIBLE

The bottom line:

- A short-term rebound still is possible. I’m not very sure though because 0.2.5 NYSE Total Volume is still very low, doesn’t look like a bottom pattern.

- Since I see another not so bull friendly intermediate-term signal, so I’m relatively sure that intermediate-term is bearish.

Why is a short-term rebound still possible? Besides the time, price and chart pattern I mentioned in the 08/20 Market Recap, which are still valid, I see 2 additional good signs:

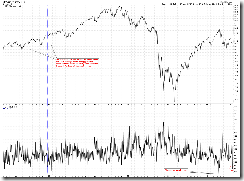

VIX Leads SPX. This chart seems work very good recently.

I’ve mentioned a possible firework setup in today’s After Bell Quick Summary. If you have read the History of the Firework trading setup then you should know it’s a powerful setup if it still works nowadays. Of course, I heard that the CPC < 0.8 today was caused by huge speculation calls on an individual stock, so whether it’s just a special event that shouldn’t be counted is remained to be seen.

To be fair, if bulls rather believe the above mentioned firework, then should equally accept the fact that according to the chart 6.1.0 Extreme CPCE Readings Watch, CPCE < 0.42 although means short-term bullish but intermediate-term is quite bearish which fits well with all the bearish statistics I listed in the 08/20 Market Recap.

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| TREND | DTMFS | COMMENT – *New update. Click BLUE to see chart if link is not provided. | |

| QQQQ | UP | SELL | |

| IWM | UP | SELL | |

| CHINA | UP | Head and Shoulders Bottom in the forming? | |

| EMERGING | UP | SELL | 4.1.6 iShares MSCI Emerging Markets (EEM Weekly): EEM to SPX ratio too high. |

| EUROPEAN | DOWN | SELL | Could be a breakdown of an important support. |

| CANADA | UP | *SELL | *Black bar doesn’t look good. |

| BOND | UP | 4.2.0 20 Year Treasury Bond Fund iShares (TLT Weekly): Too far away from MA(200). | |

| EURO | DOWN | SELL | |

| GOLD | UP | ||

| GDX | UP | 4.3.1 Market Vectors Gold Miners (GDX Weekly): GDX to SPX ratio too high. | |

| OIL | DOWN | *SELL | |

| ENERGY | DOWN | SELL | |

| FINANCIALS | DOWN | SELL | 4.4.2 Financials Select Sector SPDR (XLF Weekly): Head and Shoulders Top in the forming? |

| REITS | UP | SELL | 4.4.3 Real Estate iShares (IYR Weekly): Home builder is lagging, be careful. |

| MATERIALS | UP | SELL |