| ||||||||||||||||||||||||

| ||||||||||||||||||||||||

|

SHORT-TERM: PROBABLY THE BEAR’S LAST CHANCE IS THE NEXT WEEK

Two points:

- Probably a few more up days ahead, because even this is merely a short-term rebound, as all the recent short-term rebound had generally lasted 5 to 7 trading days, while till now the rebound has lasted 4 trading days at most, so should be a few more up days to go.

- The next week could be a key week, because there’re 2 important pivot dates due in the next week, plus the bearish seasonality and the crazy ISEE Equities Only Index (see table above), so if bear wants a revenge, the next week could be the last chance of this year. The next next week is Triple Witching week which according to Stock Trader’s Almanac, Dow up 22 of last 25; The next next next week is Christmas shortened week, unless something really bad happens, no bear would attack on such a low volume week as the sell cost would be much higher than a normal trading week; The next next next next week is Santa Rally. So again, if bear wants a revenge, either the next week or at least has to wait until the new year.

INTERMEDIATE-TERM: TO BE ASSESSED, ALTHOUGH I BELIEVE WHAT WE HAVE NOW IS NOT JUST A SHORT-TERM REBOUND

I’ll temporarily maintain a bullish view for intermediate-term, the target could be SPX 1300+ (see 12/01 Market Recap). Three reasons:

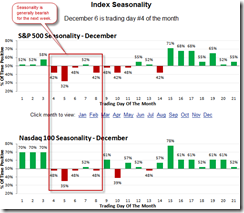

- Seasonality, see table above, blah blah.

- POMO, see table above, blah blah.

- The most important is 6.3.1a Major Accumulation Day Watch, 2 Major Accumulation Day within 5 days which confirmed all the intermediate-term bullish signals in the table above.

The reason I use “temporarily maintain” is because there’re still 2 problems (see 12/01 Market Recap):

- SPX 1227 hasn’t been decisively broken yet. Although, personally I don’t think it’s a problem. The key is “how it breaks”, whether break on large green bar or large red bar would make huge differences.

- ISEE Equities Only Index hit a 2nd record high on 12/01 while the 04/26 top happened right after the index hit a record high.

So that explains why I put “To be assessed” in the subtitle above, although right now bull looks very promising.

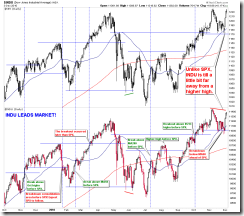

Besides the above mentioned 2 points to pay attention if indeed SPX breakout above 1227 the next week, I’d pay close attention to 1.2.0 INDU Leads Market too. If you, like me, believe INDU leads, then since INDU had a lower low, which implies that SPX eventually would follow INDU to have a lower low, and if the next week, SPX breaks above 1227 while INUD still has no higher high, then I’ll consider it as a double doom, which should be large enough to set an alarm bell.

SEASONALITY: DECEMBER HAS BEEN BULLISH

The chart below is from Bespoke:

HIGHLIGHTS OF THE OTHER ETFS IN MY PUBLIC CHART LIST

| SIGNAL | COMMENT | |

| QQQQ | 12/02 L | |

| NDX Weekly | UP | *NASI STO(5,3,3) sell signal but oversold now. |

| IWM | ||

| IWM Weekly | UP | |

| CHINA | *Could be a Bear Flag in the forming. | |

| CHINA Weekly | UP | |

| EEM | ||

| EEM Weekly | UP | |

| XIU.TO | 12/02 L | |

| XIU.TO Weekly | UP | |

| TLT | ||

| TLT Weekly | DOWN | |

| FXE | ||

| FXE Weekly | DOWN | |

| GLD | ||

| GLD Weekly | UP | |

| GDX | 12/02 L | |

| GDX Weekly | UP | |

| USO | *ChiOsc is a little too high. | |

| WTIC Weekly | UP | |

| XLE | 06/15 L | *ChiOsc is way too high. |

| XLE Weekly | UP | |

| XLF | 10/15 L | |

| XLF Weekly | UP | |

| IYR | Could be a Bear Flag in the forming. | |

| IYR Weekly | UP | Home builders are lagging. |

| XLB | 12/01 L | *ChiOsc is way too high. |

| XLB Weekly | UP |

- Please make sure you understand how to use the table above. The purpose of this report is to provide info so contradictory signals are always presented.

- Position reported in short-term session of the table above is for short-term model only, I may or may not hold other positions which will not be disclosed.

- Conclusions can be confirmed endlessly, but trading wise, you have to take actions at certain risk level as soon as you feel the confirmation is enough. There’s no way for me to adapt to different risk levels therefore no trading signals will be given in this report except the mechanical signals such as SPY ST Model.

- * = New update; Blue Text = Link to a chart in my public chart list.

- Trading signals in OTHER ETFs table are mechanical signals. See HERE for back test results. 08/31 L, for example, means Long on 08/31.

- UP = Intermediate-term uptrend. Set when I see at least one higher high and higher low on weekly chart.

- DOWN = Intermediate-term downtrend. Set when I see at least one lower high and lower low on weekly chart.