The bad news is that we still have not seen two up days in a row since October. However the good news is we get several intermediate term buy signals. As far as tomorrow is concerned, the daily chart is relatively bearish but there is no sufficient evidence to predict the market will definitely pull back tomorrow.

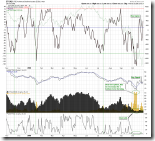

0.0.3 SPY Mid-term Trading Signals. MACD, BPSPX, and NAMO are all buy signals, except for NYSI which is still not.

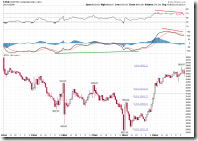

1.0.6 S&P 500 Bullish Percent Index. The buy signal of BPSPX has been confirmed by all three major indices. Previous two signals were proved to be whipsaw, hopefully the third time is not.

1.2.6 INDU leads the Market. It does not really mean INDU leads the market. What I mean is that, according to the chart in the recent one year, the progress of INDU is almost always ahead of other indices. Tomorrow INDU showed a higher high ahead of others, which is a good sign, and the next step is to see if other indices follow. By the way, while SPX and COMPQ were still lower lows, INDU clearly showed higher highs which is also a good sign.

With the aforementioned mid-term signals and two major accumulation days on 1.0.5 Major Accumulation/Distribution Days, the probability of mid-term rally should be relatively high. Should the market pull back, we will get more evidence according to how far the pullback goes.

Tomorrow the market might pull back, but I am not very sure.

0.0.2 SPY Short-term Trading Signals. Today the candlestick pattern is bearish shooting star, which has a high likelihood of trend reversal, so the market may pull back tomorrow. Of course, this pattern requires a confirmation on the next day, the pullback cannot be proved by itself.

1.0.3 S&P 500 SPDRs (SPY 60 min). This chart clearly shows that today's pullback happened while testing the gap resistance, and this is quite reasonable. Note that the resistance on RSI seems effective. If the market pulls back further tomorrow, a possible scenario is to kiss back the breakout point at the upper edge of descending triangle, which is seen very often after the breakout.

2.8.1 CBOE Options Total Put/Call Ratio. Although it does not say the market will pull back for sure, CPC is over bullish today which is not good.

1.4.0 S&P/TSX Composite Index (Daily). MACD gives a buy signal on the chart of Canadian market.

1.4.4 TSE McClellan Oscillator. There are two buy signals on the chart.

1.4.3 S&P/TSX Composite Index (15 min). However Canadian market may likely pull back tomorrow because of the negative divergence on MACD and RSI.

3.2.0 CurrencyShares Japanese Yen Trust (FXY Daily). As pointed out by readers, because there are so many gaps on FXY chart, gap down cannot be considered as an island reversal. This doesn't mean Yen won't pullback, it only says the terminology of island reversal isn't accurate.

0 comments:

Post a Comment