Today a bad news is that SPX has reached the lowest close in 2008, another one is that the symmetrical triangle we talked about before has broken out at the down side. At the market close SPX went back to the triangle, which means it must go up tomorrow otherwise the Oct 10th low will be in danger. Will the market rise tomorrow? If the market is rational, the probability of bounce back is high.

2.4.2 NYSE - Issues Advancing chart is the only hope of bulls recently. NYADV has not shown a lower low so far, which is a characteristics of market bottom. Note the SPX close only chart at the bottom clearly shows that today is the lowest 2008 close.

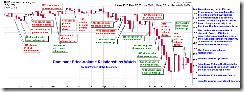

1.0.3 S&P 500 SPDRs (SPY 60 min). It has gone back to the triangle, but not much room to turn around.

0.0.0 Signal Watch and Daily Highlights. Take a look at today's signals, two mid-term buy signal have reversed to sell. Meanwhile several breadth oversold show up, again if the market is rational, these oversold signals are good news. However, given the current situation, I don't know when these signals will start to show their effects.

1.0.5 Major Accumulation/Distribution Days. Today is the second consecutive major distribution day up to now. After two to three major distribution days, we know the market may bounce back up significantly. So far this pattern works well, but the problem is that we don't know if the third major distribution day will show up before the bounce.

1.3.7 Russell 3000 Dominant Price-Volume Relationships. The dominant price-volume relationships today are 1721 stocks price down volume up, which shows that the market is oversold and due for a rebound.

So since it broke out on the down side, does this mean it will eventually have a steep fall from this triangle to the down side? Or might it break out on the up side since everything is oversold? This is a confusing market.

ReplyDeleteI really don't know. My guess is that it now has higher chances of eventually breakdown to test 10/10 low.

ReplyDeleteThats my guess too.

ReplyDelete