Summary:

Not convinced by today's rally.

Expect a pullback as early as tomorrow.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Down | Neutral | |

| Short-term | Up* | Neutral |

I’m not convinced by today’s rally:

1. 7.1.0 Use n vs n Rule to Identify a Trend Change, 3 up days vs 1 down day, still bears went further, therefore I cannot say that the market is bullish. SPX 927 is the key, if the market closes above it then I have to re-evaluate the call for an intermediate-term down trend. For bears no panic is necessary, even if SPX 927 were broken tomorrow because very short-term already is very overbought, so at least next week bears would have a chance to escape.

2. There are 2 dominant “Russell 3000 Dominant Price-Volume Relationships” today, 1361 stocks price up on increased volume which is bullish, but on the other hand, there are 1216 stocks price up on decreased volume which is bearish. A strong day ideally should have 2000+ stocks price up on increased volume so I cannot say today is a strong day.

3. Although SPX didn’t even close to a SWING HIGH but VIX already reached a new low today, this is a negative divergence which means the complacency is high.

4. I’ve discussed “All Up Day” in the after bell Quick Summary, although today missed a single point to be an “All Up Day”, but at least both stock and bond were up a lot. Since normally bond and stock are reversely correlated, so either stock lied or bond lied today. And who’s lying, we might know as early as tomorrow. Anyway, from 3.0.3 20 Year Treasury Bond Fund iShares (TLT Daily), the Head and Shoulders Bottom should be confirmed upon the breakout today which means probably the bond will rise further.

Tomorrow, I expect a pullback.

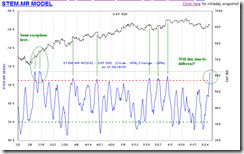

The short-term model from www.sentimentrader.com is the main reason for arguing a pullback tomorrow.

From the above chart we can see that there’re 2 exceptions for not pulling back big when STEM.MR was overbought. The question is if we’re going to have another exception this time? I’ve compared today’s case with the previous 2 cases in the below chart. Since the strength of today is far less than those of 2 cases while STEM.MR is now almost equally overbought than those of 2 cases, so I believe that the pullback this time wouldn’t be weak.

1.0.3 S&P 500 SPDRs (SPY 30 min), possible Bearish Rising Wedge in the forming. ChiOsc is a little bit too high which was fairly accurate in predicting a pullback.

2.0.0 Volatility Index (Daily), the famous VIX ENV10 is oversold today also the famous VIX BB setup is (half) triggered. Look at the red dashed lines, at least these 2 combinations worked pretty good recently. This also means a possible pullback tomorrow.

haven't said thanks in awhile, but i always enjoy reading your analysis, great job as always

ReplyDeletealphahorn

thanks for including TLT data...my expectations are for T-note yields to stay around the current range in order to attract investors at auctions next week and many traders may cover positions and take recent gains @ EOM/EOQ...imo NOV-JAN price action was historic and we are consolidating in calmer and cooler waters now...

ReplyDeletethank you for your daily work

ReplyDeletegreat job. Read you blog daily

ReplyDeleteGreat blog great charts. I read you blog each day on my way to work. If only I had more time! LOL

ReplyDeleteHave a great weekend.

Thanks. Could you update the Institutional Buying and Selling Trending chart?

ReplyDeletethanks Cobra. Great stuff.

ReplyDeleteremember to click ads to support cobra...the after hours updates he does can make you real money, and he deserves some compensation for that. But should he pay us when a call goes wrong? just kidding...

ReplyDeleteReally good stuff, Cobra. Thanks, I visit every day.

ReplyDeleteCobra I am new to your site. I tried to look at prior posting for definition of n vs n trend change but after reading through them, I still can't quite figure out n vs n rule. Where else can I go and figure this out ?

ReplyDeleteKelvin

I will update Institutional Buying and Selling Trending chart whenever I see necessary. Hope you could understand if I keep publishing it, stocktiming.com would not be happy about that.

ReplyDeleteKelvin, about "n vs n", it's just a rough rule, not a magic, I'm not even sure if it works now or not. For everything about "n vs n", I have only 3 charts to explain it, and I think you can find it in my chart book (chart 7.2.1 and 8.0.3).

Let's all complain to the SEC regarding the market manipulations and lawless "information leaks" to the privileged few...

ReplyDeletehttp://zerohedge.blogspot.com/2009/06/sec-needs-your-feedback.html

Frank

Frank, sure, I'll.

ReplyDelete