TREND INDICATOR MOMENTUM INDICATOR COMMENT (Click link to see chart) Long-term 3 of 3 are BUY Intermediate 3 of 3 are SELL 4 of 6 are NEUTRAL SPY ST Model is in SELL mode Short-term 1 of 1 are SELL 4 of 8 are OVERSOLD

BULLISH 2.4.4 NYSE McClellan Oscillator: Oversold.

0.0.6 Nasdaq 100 Index Intermediate-term Trading Signals: NADNV too high.

0.0.3 SPX Intermediate-term Trading Signals: *NYADV oversold, ChiOsc a little low.BEARISH 2.0.0 Volatility Index (Daily): *Could be a Bull Flag in the forming. CONCLUSION

SPY SETUP ENTRY DATE STOP LOSS INSTRUCTION: Mechanic signals, back test is HERE, signals are HERE.

TRADING VEHICLE: SSO/SDS, UPRO/SPXUST Model 01/27 S 1.9 x ATR(10) Reversal Bar NYMO Sell 01/21 S *01/28 High *Adjust Stop Loss VIX MA ENV

OTHER ETFs TREND COMMENT – *New update. Click BLUE to see chart if link is not provided. QQQQ IWM CHINA Down Double Top or Bearish 1-2-3 Formation? EMERGING CANADA Down Double Top, target $15.77. TOADV oversold.

1.5.2 TSE McClellan Oscillator: Oversold.

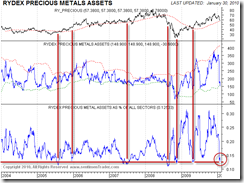

Could be a short-term rebound, but the big trend is down.FINANCIALS REITS ENERGY *Beware of Double Top. OIL GOLD 01/29 Market Recap: *Rydex traders too pessimistic about gold. DOLLAR UP Confirmed Head and Shoulders Bottom breakout!

3.1.1 US Dollar Index Bullish Fund (UUP 30 min): *ChiOsc too high, expect short-term pullback.BOND Could be a Bull Flag. So yield could rise while bond should fall.

INTERMEDIATE-TERM: MULTIPLE SUPPORT FOR SPX IS AROUND 1020-1040 AREA

2.0.0 Volatility Index (Daily), could be a Bull Flag in the forming so VIX could rise which means the SPX is doomed.

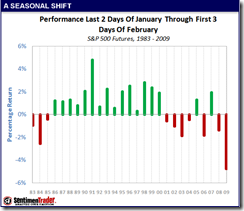

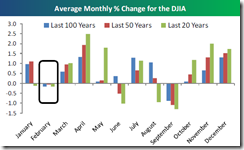

Seasonality wise, the beginning of the February wasn’t good and neither the whole month.

3.1.0 PowerShares DB US Dollar Index Bullish Fund (UUP Daily), confirmed the Head and Shoulders Bottom again and again, this should put a tremendous pressure on the stock market. Because of zero interest rate, the dollar has been the main force for the carry trade fueling almost the entire 2009 rally. Now dollar becomes stronger and stronger so the carry trade has to be unwound which means sell stocks for cash to cover dollar shorts and which in turn means more selling for stocks and more covering for dollar shorts…

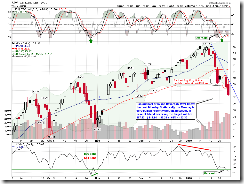

So to summarize the above, most likely the pullback isn’t over yet. 4.1.0 S&P 500 Large Cap Index (Weekly), Fib confluences area plus MA89 plus Nov lows, so logically, the pullback target could be around 1020-1040 area. By the way, from the chart, we can see, the GDX and NYSI STO also have confirmed the intermediate-term down.

The latest II Survey shows much less bulls but unfortunately those running bulls didn’t run into the bear’s camp, instead they’re in correction camp. So far from the red vertical lines, I don’t see high number of people in correction camp means anything significant for bulls.

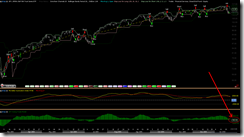

SHORT-TERM: BEWARE OF ISLAND REVERSAL

As mentioned in the After Bell Quick Summary, there’s a chance we could see a green Monday. 1.0.3 S&P 500 SPDRs (SPY 30 min), Declines to Advances ratio keeps decreasing meaning the sell pressure is constantly easing therefore it’s good for bulls too.

0.0.2 SPY Short-term Trading Signals, however beware of the possibility of an Island Reversal. If so, then pattern also confirms the intermediate-term downtrend, which is very bad, as so far till now, I have only indicators confirming intermediate-term down, no pattern confirmation yet which is far more reliable than indicators.

About gold, looks like Rydex traders are too pessimistic about it, so gold could rebound, I’m not sure, as I have no idea how the strong dollar is going to affect the gold if indeed it rebounds.

STOCK SCREENER: For fun only, I may not actually trade the screeners. Since SPY ST Model is in SELL mode, only SHORT candidates are listed. For back test details as well as how to confirm the entry and set stop loss please read HERE. Please make sure you understand the basic risk management HERE.