Summary:

Could be a short-term rebound at least Monday morning.

Could be a weak short-term rebound because of the flight to risk on Friday's sell off.

VIX has potential of rising more which paints a gloomy intermediate-term.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Down | Neutral | |

| Short-term | Down* | Neutral |

Since short-term model from www.sentimentrader.com is oversold, so we might see a rebound at least Monday morning.

But, I see a flight to risk on Friday's sell off:

1. ISEE “All Equities Only” rose even to 199 on Friday which means that retailers were almost 2 times more bullish than being bearish. The “All Indices & ETFs Only" was closed at 100 which I’ve discussed here before, as since the March rally, every time we had readings greater than 100, short-term bulls were not very pleasant.

2. 2.3.4 Nasdaq Total Volume/NYSE Total Volume, speechless. For the longer history view, please refer here: 8.0.1 Use NATV/NYTV to catch the market top/bottom. Also, don’t forget that the Tech Bullish Percent Index is still overbought, so even we treat this unusual high NATV:NYTV ratio as a positive sign there might not be much upside room left.

So based on the above info, I tend to believe the short-term rebound if any, won’t be strong. While on the other hand, there’re good chances that we’ll see another Major Distribution Day. 7.1.3 Major Accumulation/Distribution Days, Friday was a Major Distribution Day. Because a good rebound had already occurred after the previous 2 Major Distribution Days, so now the Friday’s Major Distribution Day should be counted as the first Major Distribution Day which means there’ll be a 2nd Major Distribution Day.

Intermediate-term looks gloomy to me as VIX has very good chances to rise further.

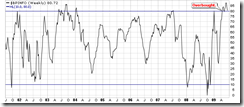

2.0.1 Volatility Index (Weekly), long-term support plus possible Bullish Falling Wedge plus STO positive divergence, VIX should have pretty decent chance to rise from here.

From Seasonality, here’s a good post: VIX at Seasonal Cycle Low.

7.3.3 VIX:VXV Trading Signals, this chart also says that VIX will rise since VXV could be seen as what VIX looks like in 3 months.

OK, lastly, let me conclude this report with a quote from John Murphy:

A PATTERN WITHIN A PATTERN... Earlier in the spring, I wrote about the possibility of a major "head and shoulders" bottom forming in the S&P 500. I drew a potential "neckline" over the January high which appears to have stopped the spring rally. That sets the stage for the formation of a possible "right shoulder" as part of a bottoming process. I wrote last weekend that a retracement of 38% to 50% of the spring rally was a likely downside target for that correction. The green Fibonacci retracement lines in Chart 2 shows those potential support levels. (The 62% retracement line is just above the level of the "left shoulder" formed in November and can't be ruled out either). The smaller (pink) neckline drawn under the May/June lows highlights the smaller head and shoulders top that I've identified recently. A close below that smaller neckline (which appears likely) would turn the short-term trend lower. [The actual downside target from that smaller top measures to 820]. Since the spring rally lasted three months, a downside correction shouldn't exceed that amount. That puts the outer limit for another bottom sometime in September (which fits with a usual seasonal autumn bottom). So while the short-term picture has worsened, the longer-term view remains more positive. I suggested a couple of weeks ago that "short-term" traders take some profits. Longer-range investors should view a downside correction over the summer months as an opportunity to do some buying at lower levels.

Cobra. Thank you for all the work you do. It is very much appreciated and it is the first site I read in the morning (BST) and sets me up for trading UK markets.

ReplyDeleteI read many blogs each day but have never posted. Like a lot of readers I believe this market to be manipulated and propped up by liquidity flows provided via the Fed as the merits of improving data are spraffed across the newswires. I am very concerned about the negative divergences that are every where. “The hand that giveth………..”

FTSE 100 and EUROSTX50 look to be on verge of rolling over and a helpful shove from you guys stateside may just get the party started.

Looking at your work, which you kindly posted over your holiday weekend, leaves me hopeful that the game might just start getting a bit fairer in the very near future.

“From a little spark may burst a flame” Dante Alighieri

Thanks for all your astute analysis.

Mr. Hoof

Hi

ReplyDeleteCobra,

Let me send you my last analysis Nikkei.

I change picture of my analysis. Now I don`t need to send mail blog. Must better I only want change analysis.

http://2.bp.blogspot.com/_MJqKtyMMr28/Sk_N4gYiw0I/AAAAAAAAAZ0/WrDmmq8GRMw/s1600-h/nikkei+05072009.png

Big trades for you.

Cobra, just wondering, do you look at COT chart at all? I've been trying to make sense to COT, before the big plunge, it seems large spec are usually right, but now not sure who is right anymore, sometime commercial is right... Both party has been pretty flat (one is very long and the other very short) until now, they just had a large position swap again, so who is right this time?

ReplyDeletehttp://www.buythebottom.com/cot_charts/s&p_500.html

Frank

2.3.4 Nasdaq Total Volume/NYSE Total Volume, speechless chart indicates that the stock market is about to crash...big time. I would set up shop on the short side and sit back.

ReplyDeletewe are headed to down 8000 short term (ie within a week) as the next "true" potential support... that's how I am reading the tape and charts myself

ReplyDeleteIMO...

as always, great work Cobra

down=dow (sp)

ReplyDelete