Summary:

Still a pullback tomorrow is possible even AH was so bullish.

I don't see new high coming soon.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Down | Neutral | |

| Short-term | Up | Neutral |

AH was so bullish after INTC ER, will the stock market skyrocket tomorrow? Well, I remain skeptical simply because the short-term overbought caused by yesterday’s rally wasn’t corrected today.

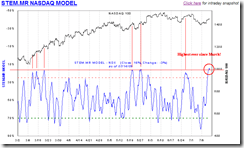

Short-term model from www.sentimentrader.com, a new high today. Although the overbought on this model doesn’t mean a pullback, but at least one day consolidation is a must.

1.0.3 S&P 500 SPDRs (SPY 30 min), a few negative divergences which usually means a pullback is due.

0.0.2 SPY Short-term Trading Signals, VIX ENV 10, a well known sell signal was triggered today. At least it means not much room left on the upside for the SPY.

So, to summarize, short-term upside might be limited and it is still possible we’ll see a pullback and even a red close tomorrow.

Intermediate-term, since VIX almost new low, I still don’t think SPX will have a new high soon, after all, it's just a rebound. The following chart illustrates a similar case in last Aug when SPX and VIX had negative divergence. Comparing with the current SPX and VIX negative divergence, looks familiar?

You are the best!

ReplyDeleteThanks Cobra! You are always daily read for me -- and I very much appreciate your charts and thoughtful analysis. You are the best!

ReplyDeleteThanks. But I'm not the best, especially if we have a great up day tomorrow. I might feel very lost... It's not easy to trade those days especially if one has to write a report every day. Thanks again for reading my post!

ReplyDeleteWell, gotta hand it to you, Cobra. You're one of the best.

ReplyDeleteWhat is with this idle worship? You are the best? I surely appreciate it, but how about some real discussion, with the thanks as just a part of your posts?

ReplyDeleteI just recently discovererd your blog and am a daily reader now. I do like the several charts that you pull up and the insights that you show us. Making a report like this every day must be difficult. Thanks!

ReplyDeleteGood stuff, as always, Cobra! The stuff you put up and point out is not the kind of stuff I see from the other bloggers. Thanks for what you do!

ReplyDeleteWednesday 07-15 is a Bradley Turn Point day,..and a 34 day cycle likely turn date. Because we have moved UP into this timeframe (and as Cobra notes,.are very overbought on ST indicators),..it is likely that we will see some sort of High on Wed,..with a turn lower.

ReplyDeleteMy short term cycle work,...next 3 wk cycle (likely pivot date) is tomorrow, Thurs 07-16. Not sure what to expect,..ie. if it will come in as a High or a Low.

One thought on my mind,... previously, hasn't the market reversed soon after reactions to favorable or disapppointing INTC earnings?

Regards, Jim P.

Thanks, Jim, let's see how market unfolds as I'm still shocked.

ReplyDeleteYes, statistically, INTC er means an opposite direction of the future stock market. We'll see if this time is different.

Well new low on $VIX! Wow...

ReplyDeleteFrank

I doubt more and more the second crash everyone around here expects. I wonder if the bearish perspective of people attracted to this blog, leads to viewing the reality as way too dark.

ReplyDeleteneed to post more than mean reversion setups to warn of multi day trends...seems like setups are good for next day.while ignoring the longer term trend..sorry.wrong for two days is just that..WRONG..and an opportunity to tweak and improve.

ReplyDeleteno different than using oscillators in a trending market..get your head chopped off

Cobra,

ReplyDeleteCheck out VIX reversal candle. It is also up today. Unless we get a monster close, we will prob have a up day for both VIX/ SPY.

Also call/ put ratio not moving although I use this metric a lot less than in the past.

http://stockcharts.com/h-sc/ui?s=$CPCE&p=D&yr=1&mn=8&dy=0&id=p51070021932&listNum=1&a=162852543

Yes, I've noticed that VIX is green on the day. Right now I'm curious that in After Bell Quick Summary today if I mention this (assume we close both green with VIX and SPX) and accordingly predict a down day tomorrow, what kind of reacitons I'd get? I bet some bashes are for sure...

ReplyDeleteBut if we crack 93 by a decent bit, I would think that retesting previous highs at 96 would be v probable.

ReplyDeletehttp://stockcharts.com/h-sc/ui?s=SPY&p=60&yr=0&mn=3&dy=0&id=p94941011682&listNum=1&a=159663290

Agree, just not that easy to 96 without a pullback first, as it's a hugh consolidation area.

ReplyDeleteEither way, the recent action is really messy.

ReplyDeleteIWM has a v clean head and shoulders pattern, SPY and ok one, and DIA/ QQQQ weaker ones.

The last few weeks could be seen as a broadening wedge which can mean a breakout move up or down.

Considering how we are oversold now on the SPY daily stochs, Im betting on some near term wkness.

Yeh assuming we start movingdown tomorrow, if we dont close that gap quickly, I will be watching to make sure this move doesnt start back up again.

ReplyDeleteCobra, what are the causes of vix going green on an extremely powerful up day?

ReplyDeletePeople are buying puts, I guess.

ReplyDeleteRetail idiots like myself.

ReplyDeleteI bought a ton just now.

No doubt China will release good numbers tonight and the rest of the bears ought to capitulate tomorrow. And not to mention the earnings mine field over the next few weeks.

ReplyDeleteTomorrow likely to be higher regardless of all the divergences.

Betst to all,

-A.

Sorry guys, but two very essential points seem to be missing in your deliberations:

ReplyDelete1.) the breakout on the non-logarithmic chart of the SPX: the price broke out of the long term downtrend today - that's the technical background of today's rally

2.) the weakest sector of the big decline down to 666 were the banks - and today they are powering ahead, leading the market higher

Thanks Uempel,..

ReplyDeleteJust wondering if you view this 07-15 Bradley date as meaningful,..Likely High? or turn UP off a Low?

Here are some Bradley plots:

http://www.marketclues.net/bradley.gif

http://www.amanita.at/Interessantes/Artikel/detail.php?id=310

http://www.rosecast.com/bradley2009.htm

Direction of plot is not meaningful,..only the date(s). And as you can see, most of these plots indicate this July 15th time frame as important.

Thanks much.

Regards, Jim P.

Hi Jim,

ReplyDeleteI had never heard of this Bradley Indicator, never heard of Donald Bradley. I just had a look at the websites you listed. The websites do not explain how the indicator is calculated. I never trust any tips or bits of advice which I cannot re-enact.

The purpose of my trading is to make money. I try to do this with indicators which have proven themselves to me. I know these indicators inside out. No sense for me to use an unknown indicator, which seems to be quite elusive.

The sine qua non of trading is to execute trades which make sense. And to exit immediately if the odds go against you.

As to cycles: a few days ago two cycle indicators gave signals - apparently they were buy signals.

Thanks Uempel,

ReplyDeleteAgree with you strongly on importance of making money.

I only self trade a portion of my accts,..the majority is in a "managed" program.

Both the "self" and the "managed" portions use end of day priced Rydex SP500 funds (either Long or Short),..with focus on very next day direction.

Never easy.

Regards, Jim P.