Summary:

Could be a down day tomorrow.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Up | Overbought | |

| Short-term | Up | Overbought |

Because the final correct CPCE chart from www.stockcharts.com is only available after 7:40pm ET, so today’s After Bell Quick Summary missed an important readings: CPCE < 0.56. This reading should have cancelled the 2 bullish effects caused by CPC < 0.8, which are 77% chances a green close next day and a firework thereafter. So CPCE < 0.56 plus “both SPX and VIX are green on the same day”, now it looks like higher chances a red close tomorrow.

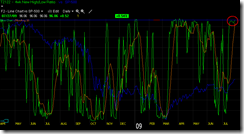

2.8.0 SPX:CPCE, from this chart we can see that whenever CPCE < 0.56, the next day wasn’t very pleasant. Also about CPCE here are some statistics: Equity Put/Call Ratio Suggests Down Day.

7.0.4 Extreme CPC Readings Watch, from this chart we can see that CPCE has higher priority, even CPC is bullish.

7.3.2 Firework Trading Setup, likewise, CPCE has higher priority.

Nothing else to say. Lots of Elliott Wave analysts have predicted a final push up then a bigger pullback and then a new high. 1.0.3 S&P 500 SPDRs (SPY 30 min), a smaller Bearish Rising Wedge could be formed, plus lots of negative divergences, so it supports what Elliott Wave says: a pullback is very close.

T2103 Zweig Breadth Thrust from Telechart, still overbought.

T2122 4 week New High/Low Ratio from Telechart, the overbought worked even in the most bullish period. But from this chart, the market may still have a little up room though.

Hi Cobra,

ReplyDeleteI am not getting your point about CPCE. I was back testing and I found that every time when this index drops a lot (like today) it triggers a rally in the next day (for example on 07/01 and 07/13). What I am doing wrong?

tks

AJVS

Hi Cobra,

ReplyDeleteAny target you have in mind for a pullback ? Thanks.

Cobra,

ReplyDeleteRe. a good source for cycle related info,

..here is a blog from a friend of mine:

http://timeandcycles.blogspot.com/

Regards, Jim P.

PS Still open minded to an UP day on Tues,..in part due to oversold STEM.NR models.

Bob, I'm not sure about the target. Generally, 960 area should be the first target.

ReplyDeleteajvs, extreme CPCE readings are different during different period, so it cannot be simply back tested.

ReplyDeleteJim, thanks. I'll watch that blog.

ReplyDeleteJim, it's really a nice blog. Just the update is too less. Wouldn't he mind that I "borrow" some ideas from him?

ReplyDeleteHello Cobra,...

ReplyDeleteI checked with Ian (author of the blog) and he said sure,..as long as you reference the source when you make a post, etc.,...not a problem.

I have followed Ian's work for years and find it to very worthwhile with regard to cycle anslysis and related projections.

Regards, Jim P.

Jim, thanks, I borrowed the weekly cycle. But it seems that I have the same 60min and daily cycle.

ReplyDelete7.6.2 is what I've borrowed. I've put the blog URL on the chart. Thanks again Jim. I'll read more on his blog to see if I can borrow more and based on that creating my own "cycle" system.

ReplyDeleteCobra,...

ReplyDeleteYou're very welcome.

If you would like,..I could share with you other cycle based analysis. Feel free to drop me your email.

My main email is pilliod618@yahoo.com

Regards, Jim P.