Summary:

Expect at least a short-term pullback staring as early as tomorrow.

A Head and Shoulders Top could be in the play.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Down | Neutral | |

| Short-term | Up | Neutral |

Short-term, SPX might have not much room left on the upside, even it has already turned down.

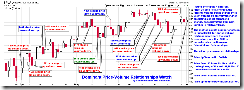

1.0.2 S&P 500 SPDRs (SPY 60 min), quite a few reasons on this chart.

1. A strong resistance area ahead formed by 10 trading days long consolidation.

2. Today is the end of 13 trading day cycle therefore it could be a turn date.

3. Bearish Rising Wedge.

4. Lots of negative divergences.

5. 8 unfilled gaps.

6. The rebound hit exactly Fib 61.8.

3.1.1 PowerShares DB US Dollar Index Bullish Fund (UUP 30 min), Bullish Falling Wedge plus lots of positive divergences, US$ could rebound which is not good for the stock market.

Intraday model from www.sentimentrader.com, overbought.

Intermediate-term, a Head and Shoulders Top could be in the play.

0.0.2 SPY Short-term Trading Signals, so far SPY stalled under MA20, 2 days up were on decreased volume while the only 1 down day was on increased volume.

7.7.9 Russell 3000 Dominant Price-Volume Relationships, this proves the above mentioned up on decreased volume scenario: Both Monday and today had 12xx stocks price up volume down.

2.0.0 Volatility Index (Daily), 3 reversal bars in a row, if the candlestick pattern is of a little little use, VIX should rebound now, this is not good for the stock market.

Also don’t forget, VIX had another new low today, this is a negative divergence.

I agree 110%...think we pull back all the way into the end of next week from here.

ReplyDeletesee what happens at 878, i think we are going right back there very soon, jmo..

beware of light volume short squeezes on Thursday, unless bad data overcomes it

ReplyDeletenext week should be fun for sure

great stuff Cobra. My slightly different analysis - mainly quants models with IV and volume tell me a similar story.

ReplyDeleteit's been quite frustrating up here in the market stratosphere. Not to say the market signals have not been correct...it just frustrating to see how long it all takes to play out....

how much longer...???

Wow, Cobra, some good info and helps to corroborate what I am about to post.

ReplyDeleteSince we're entering a crucial timeframe and since my cycle timer has failed me with his call now for the rally to continue into Nov after next week after spending the last several months calling for a high in July and ignoring his own cycles which he now says have gone underground, (he's also one of these a-b-c rally e-wavers which has been frustrating to deal with) I've decided to take my own shot at cycle timing since I noticed a few things this week. First, I feel the SPX950 area is key resistance that most likely won't be broken. It's the opening year trading range and supported by the Jan high level and staying below this level keeps the intra-year trend down. As Schweizer and a few others have noted the upper parrallel bar connecting the tops of this bear market hit the 950 level back in early June and will provide another form of resistance. Anyway, that parallel line is still dropping and the 930 level is now providing key resistance. 200 day exponential average has provided key resistance also at the June high and is now in the 930 area.

July brings us to the onset of the Puetz crash cycle. On July 7th, there is a lunar eclipse which is one of the triggers required for the crash signal but there is another one a month later. In between, there is a solar eclipse which is the other trigger for the cycle. Ideally, this signal isn't triggered until after the solar eclipse but it is highly unsual that two lunar eclipse would occur around a solar eclipse so who knows what to expect. The market could take its initial plunge from the July date and rally back to a August later in the month.

But this week could also be a key turn cycle also due to a few things I picked up on. First, I noticed the May '08 high (week of 19th) and June '09 high(three weeks) are a Fibonnaci 55 weeks apart which tell me that the early June high should hold as a significant high. It is also part of a regularly recurring weekly cycle during this bear market.(this is someone else's work so I won't identify it. It's on his website if you know who he is). This week is a Fibonnaci 89 weeks from the alltime high of Oct. '07. If you split up those 89 weeks, 55 weeks from the alltime high is the first week of Nov.'08 which is an important secondary high. If you split up the next 34 weeks, you get the March low at the halfway point (17 weeks down to the March low,17 weeks to here) So although this week might not be a major high, it could be an important secondary high/turning point. And it was posted on Kenny's board that a key turning date should have occurred on June 30, tied to dates in Jan and July '08 and Jan 26,'09.

To be cont.

Cycles cont....

ReplyDeleteThat turn date cycle for June 30 was a Peter Eliades turn date and the last one was on Jan 6th not the 26th. Since we didn't get a turn, I decided to look at it from a weekly perspective. Voila 25 weeks from the July '08 low was the week of the Jan'09high and 25 weeks later is this week. Since we are so close to the early June high, the only way this week could have any significance is if a freefall were to occur from here. It doesn't mean that we don't just trade slightly down to sideways the rest of the week and then freefall on July 6 or 7. Those dates have some key cycles also. July 6th will be 4 months from the March low, 6 months from the Jan high.

Also, a poster on the other board showed that the SP hit resistance at its 200 monthly moving average at the June high as well as some other interesting trendlines from underneath. Eliades has some similar comments on trendlines.

Martin Armstrong also for some reason thought that the week of July 5th would be an important bottom but I haven't seen any info lately from him so I can't determine what type of cycle it is. He has also mentioned that this bear market could last a PI 31.4 months so I counted 31.4 months off the Feb '07 high for the $bkx and that would bring us to mid to late September '09 for a low.

If one looks at the chart of the Panic of 1907, this bear market looks almost identical except the scale is grander (supercycle scale). There was a 4 month consolidation following the rich mans panic of March 1907 before the market went into freefall in late July to culminate into the Panic of 1907. And this bear market started on the 100th anniversary of the Panic of 1907. A late August,Sept,October low would correspond to the Panic of 1907 model depending on what perspective one takes. The 9 month cycle low should be apparent around that time also. (Ideally late August,early Sept) But I'll focus on potential lows later. The Bradley model,4 year cycle, and the next fib number 144 (weeks from the high) would indicate the bear market could run into July 2010.

Of course, I could be completely wrong and we get a low next week and the market breaks its channel and embarks on its C wave. But bullish percentage and stocks above 50day average indicate that we're still in a correction and both still need to drop to around20% before the correction is over. Can it do that in a week?

Mr. Panic of 1907/2009

Cobra, I just wanted to send you a word of encouragement, I consider you to be the best TA person period I have encountered. You're the best around, you have no competitors. Hope all is well. You may notice off stockstop I have a bullish overall stance short timeframe (very short), I am waiting for LR extremes to put on a different posture. In a MM controlled market, I just need to hedge my bets by playing these extremes. Swing by stockstop if you have a chance. Analyze.

ReplyDeleteCobra,

ReplyDeletePlease post daily seasonality for July.

Thank you!

Mr Panic...

ReplyDeleteI agree as well. And, here is some more facts to support that theory... As we all know by now this market has clearly been manipulated extremely well during this bear market rally. In the past, this wouldn't have been possible. But, with Obama printing more money in the last 6 months, then America has done in her entire 233 year history... they've (Goldman Sachs) had a lot of extra cash to control this market with.

With that being known, they also have been selling heavily in the last 2 months. They know that the crash is coming, so they sell their worthless stock to the unsuspecting public. But, the most important signal is that they have been buying large amounts of July/August VIX Calls. As of yesterday, one unknown buyer has now bought a total of 425,000 VIX Calls. They are mainly 40 and 45 strike prices, expiring in August and some in July. That's a lot of calls when the VIX is around 25 today. Somebody knows something, that's for sure!

Dan Black

A different perspective via TrueContrarian...

ReplyDeleteTOO MANY NERVOUS BULLS ENSURE AN EQUITY PLUNGE JUST AHEAD (June 24, 2009): If you've been paying attention to the financial media in recent weeks, then I'm certain that you've noticed a sharply increasing number of analysts who are making remarks such as this: "The S&P 500 remains bullish as long as it remains above 875". Some analysts substitute similar support levels such as 860, 870, or 880 instead of 875, but their outlook is otherwise identical.

This line of reasoning has progressed to the point where it is a nearly unanimous consensus. Therefore, what must inevitably happen is that one fine day in late June or early July of 2009, the general equity market will break below the topmost of these popularly followed support levels. This will trigger sell stops from all of those investors who have decided that they will reduce or eliminate their equity exposure once such a target is broken to the downside. The resulting pullback will cause the next support level to be hit, thereby inducing more selling, and so on, until everyone with this viewpoint has turned bearish. This will probably cause the S&P 500 to complete a short-term bottom near 837. As a result of this retreat, there will likely be some fresh short selling by those who believe this event has ushered in a key downside breakout.

Since so many are positioned to unload rapidly when their pet support level is violated, the market will likely flush out all of these nervous bulls within just one or two trading days. Afterward, there will likely be a period of several trading days of above-average volatility in both directions, as investors become confused as to what will happen next. The following headline will become commonplace: "Will we retest the March lows? Analysts are divided in their opinions."

Following this period of indecision, some tentative buying will emerge. Hedge funds and pension funds worldwide are currently severely underinvested in equities as compared with their target allocations. Therefore, since hedge funds love to buy into any rebound which follows a sharp pullback, these funds will all be rushing back into the market at the same time. Those who sold short following the alleged downside breakout will simultaneously hurry to cover their short positions. This buying spree will be as intense and as brief as the previous rapid pullback had been.

Within a week or so thereafter, the S&P will likely regain the 900 level en route to the most powerful phase of its entire 2009 rally which began in early March. The quick bull market will likely end this autumn with the stock market returning to its levels of early September 2008. That could result in the S&P reaching 1300.

http://www.truecontrarian.com/

Mr. Panic and Dan and TrueContrarian, thank you so much. Great info you all have here! And I'm sure you are all enjoying your day now...

ReplyDeleteCobra, check out ISEE, is on Fire again! Total indicies/etf is above 100! (way above) and equity is almost 200, in the 190s! I hope ISEE can end the day like this... that would bode will for Monday session... :)

ReplyDeleteFrank

Wow, indeed, ISEE is so bullish...

ReplyDeleteCobra, "wow" is the correct word! If ISEE keep up bullish like this as we go down, it would be some nice fuel for the bears... :)

ReplyDeleteFrank

I used to read truecontrarian avidly until he went bullish in late '08. When we get to SP830, all the new bull market guys are going to say we had a successful retest of the low while all the bearish ABC e-wavers will say we made the B wave low and in the ensuing bounce off that level, there will be a higher level of bullishness than we have had up until now.

ReplyDeleteAnd I forgot to mention, the monthly SP made a spinning top(doji?) formation in June.

Mr. Panic

Mr. Panic,

ReplyDeleteI saved one of True Contrarians posts from January, 2007:

" DEFLATIONARY WAVES AND COUNTERWAVES (January 1, 2007): The mainstream financial media keep talking about "rising inflation", while Fed officials continue to make comments about "persistently high inflation". However, if one looks at a chart of gold mining shares, or a chart of U.S. Treasury yields, one quickly discovers the truth: on May 11, 2006, the worldwide financial markets began an important deflationary wave which will likely continue for the next several months or longer.

The first assets to be pressured lower by this deflationary wave were the prices of precious metals and their shares. Treasury yields then followed in the second week of July; copper, in the middle of October; U.S. equity indices, in late November and in December; other base metals such as nickel and zinc and tin, probably later this month. Over the next several months, equity indices worldwide will move noticeably lower, as will the prices of artwork, racehorses, and a vast array of overvalued assets. Real estate, the most uniformly overvalued asset of all, began the deflationary cycle in late 2005.

All waves have their corresponding counterwaves. Once the U.S. Federal Reserve and other central banks worldwide realize that this deflationary wave is having serious consequences such as rising unemployment and more rapidly declining real-estate prices than had been anticipated, these folks will begin to aggressively cut interest rates. This will engender a temporary pause to the deflationary impulse, and will create an environment of rebounding assets, especially for precious metals and their shares, as well as for other assets that had generally gone out of favor in the past several years, such as largecap growth shares. This rebound will likely begin around the summer of 2007, and will last perhaps for 1-1/2 years.

However, central bankers can only do so much. They cannot prevent an even more powerful deflationary wave from regaining control in 2009. This deflationary wave will be far more devastating than the current one. It will likely cause a huge worldwide pullback in equities, similar to what was experienced in 2000-2002. Real estate, both precious and base metals, artwork, and virtually all major asset classes will see a significant decline in their respective valuations. Unemployment will surge into double digits in many countries, even possibly in the U.S. The U.S. might experience year-over-year deflation for the first time since 1931.

(Continued below)

DEFLATIONARY WAVES AND COUNTERWAVES (continued)

ReplyDelete"Once this worldwide asset collapse ends, perhaps in 2011, it will be followed by one of the greatest reflationary periods in world history, as governments worldwide do whatever they can to stimulate the economy, without regard to inflation or rising interest rates. Interest rates will likely double in most countries within a few years, including the U.S. Precious metals and their shares will surge, with gold soaring well above the $1,000 per ounce level.

Baby boomers and other retirement investors are likely to get wiped out twice. As the deflationary waves cause equity indices to collapse, 401K participants will--far too late--move whatever money is left from their collapsed equities into the "safety" of bonds. Just as the maximum number of participants are in bonds, interest rates will then more than double, thus wiping out much of these bond holdings with a few years. After achieving a very deep nadir, equity indices will see their greatest percentage gains in many years, but few people will remain in these investments to benefit from them.

While all of this up-and-down excitement is going on, real-estate prices worldwide are likely to move in only one direction--lower--eventually surrendering all of their gains in nominal terms since 1999. Thus, these deflationary waves and counterwaves will cause a great decrease in global prosperity.

These are my cheerful thoughts for the New Year. Be sure to get out of the stock market in time, so that you will enjoy a prosperous 2007."

For 2008, he failed to anticipate the collapse of Lehman Brothers. But on the whole he was pretty much on target.

Can you post the latest institutional buying & selling after today's session? Thx.

ReplyDeleteThe latest Institutional Buying & Selling chart will have to wait until next Monday morning.

ReplyDelete