Summary:

Changed long-term trend from down to up, also explained the criteria for setting the trend table.

Could see a pullback early next week.

A few charts giving bears some hopes but they're not guaranteed to work, need to keep monitor them.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Up* | ||

| Intermediate | Up | Overbought | |

| Short-term | Up | Neutral |

In the trend table, I’ve changed the long-term trend from down to up, because weekly EMA13 had a bullish crossover EMA34. In order to avoid “bias”, so I simply use trading signals as the criteria to mark “up or down” in my trend table. The following 3 charts are what I use to set the long-term, intermediate-term and short-term trend accordingly.

7.3.0 SPX Long-term Trading Signals.

0.0.3 SPX Intermediate-term Trading Signals.

1.0.3 S&P 500 SPDRs (SPY 30 min).

Well, since they are simply signals, so there’s no guarantee whether they'll work or not this time, PERIOD.

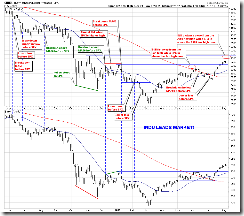

I tend to believe we’ll see a pullback early next week. As mentioned in the After Bell Quick Summary that we might see a red Monday, in addition, 1.0.2 S&P 500 SPDRs (SPY 60 min) shows too many too big negative divergences, besides the 7 and 13 trading day cycle was due on Friday (see vertical lines), so it’s possible that Friday was a turning day. For the longer history of 7 and 13 trading day cycle please refer to chart 7.6.1 SPX Cycle Watch (60 min), the cycle worked not bad in the past.

There’re a few other charts supporting my view for a short-term pullback. Just these charts usually don’t work immediately and also may be “fixed” if the market keeps going up. So these charts are to be monitored.

As mentioned in Thursday repot, SPX new high while NDX didn’t. This is a negative divergence and if the May case repeats, we’ll see a little bigger pullback. On Friday, this kind of divergence became even bigger.

Since I mentioned a possible “Nasdaq leads market”, a reader asked what about my so called “INDU leads market”? Here is the chart: 1.2.0 INDU Leads Market, SPX break above Nov 2008 high, but INDU so far hasn’t confirmed it.

3.1.0 PowerShares DB US Dollar Index Bullish Fund (UUP Daily), US$ rose sharply with huge volume on Friday. I think we need to pay attention here, if it’s not an one day wonder then US$ might be bottomed which means a pullback for commodity and commodity related stocks and therefore is not good for the stock market. 3.1.2 PowerShares DB US Dollar Index Bullish Fund (UUP 30 min), by the way, Monday, we may have a chance to verify if the Friday’s US$ rally is an one day wonder or not. Because RSI overbought, if US$ pulls back big on Monday like what it did before whenever RSI was overbought, then most likely the Friday’s US$ rally was only an one day wonder.

5.0.5 S&P Sector Bullish Percent Index I (Weekly), 5.0.6 S&P Sector Bullish Percent Index II (Weekly), I’ve put all the bullish percent indexes that are overbought into below chart. Pay attention to NYSE and Tech, they’re very close to (or already at) a record high now.

Cobra

ReplyDeleteThanks for sharing all your hard work. It is greatly appreciated!

****Dan Black...

HAPPY BIRTHDAY tomorrow. Hope to ride the elevator down with you on Monday. Be looking for you over at "ES".

Douala

outstanding work, thanks Cobra!

ReplyDeletemy 2 cents on the LT trend, clearly it's up from here, but i won't switch to net long until stochastics come down from these over bought levels.

Dan Black's comment to Mr. Panic.

ReplyDelete"I lost on those both FAZ and FAS several times. Never buy calls on either, as they are both designed to go to zero over time."

these dynamic profunds are subject to data mining, but i haven't tried to find an usual example....

last 5 months of XLF up 78%, UYG up 138%, FAS up 201%, while SKF is down only 80%, FAZ down only 94%....

http://stockcharts.com/h-sc/ui?s=SKF&p=D&yr=0&mn=5&dy=0&id=p47014460732

in principal Dan is correct these profunds are not LT buy and holds, but it appears a 6 month hold won't kill you.

"usual" should have written unusual

ReplyDeleteYikes! i made a huge mistake Dan Black is 100% correct... my first study was misleading... this point of view is more correct...

ReplyDeletehttp://stockcharts.com/h-sc/ui?s=SKF&p=D&yr=0&mn=5&dy=0&id=p87896024243

Cobra,

ReplyDeleteAs usual, great work. Thank you for stiking to the chart and putting forward unbias commentary that is purely based on charts. Awesome work...

I am certain that most of you know this but Mr. Bob Pretcher has asked his readers to go cash or short. The mighty Wave 3 shall begin shortly and will take us down.

Thus, be careful there.. & trade safely....

On the Bob Pretcher wave count comment above:

ReplyDeleteEverywhere I go whether "Molecool" on Evil Spectulator or "Dr McHugh" everyone has a different wave count. How accurate has Pretcher been on his wave count since April till now? Also do you believe him to the point you are willing to short like hell? I would really appreciate your thoughts. I have become really confused on this EW count lately. Thank you!

Anonymous (10:17 AM & 10:43 AM),

ReplyDeleteI've learned my lesson on those 2x and 3x ETF's. The only way to win is with "Puts", (unless you are day trading of course). Actually, you get the added benefit of time decay not killing you in a sideways market. Just like Fujisan (over at Evil Speculator) buys Credit Spreads to benefit from time decay, you can almost have the same benefit on those types of ETF's.

For example, when you buy an option, you only have a 33% chance of winning. The market can go in 3 directions... UP, Down, and Sideways. If you are betting on it to up, then a sideways or down move, that continues until your option expires, will make you lose. The same is true if you bet on the market to go down and it goes sideways or up. You lose on sideways moves because of time decay, and of course you lose if it moves in the opposite direction.

However, if you are an "Option Seller", then you win 66% of the time. If you bet on the market to down, and sell "calls", then you collect the cost of the option upfront, and only have to pay it back before it expires. You want the market to go down or sideways until it expires. Time decay will kill the price of the sideways move, and of course a down move will kill the price of the call too. You get to close out the position close to option expiration when the option is almost worthless because of either the time decay or because the market with down as you predicted. The same is true if you sold "puts" thinking the market would go up.

So, the simple analogy is that your odds of winning are 33% when buying options, and 66% when selling options.

Continued...

Now, let's look at how those 2x and 3x EFT's function, and why they are ideal for "Put" buying.

ReplyDeleteSince normal stocks or ETF's lose on the time decay in a sideways market buying puts or calls is risky. But, what if the you time decay was slowed down, and your option value might actually increase during a sideways move? You can do this by buying "Put's ONLY" on those 2x and 3x ETF's. For example, let's look at how a simple one month sideways market would affect a normal ETF (like SPY), and a 2x or 3x ETF (pick one... doesn't matter).

Let's say that the SPY is at 100, and the 2x/3x ETF is also at 100. Let's also say that you think the market is going down in the next 2 months. You purchase a SPY 100 Put that expires in 2 months. You also purchase a 2x/3x ETF 100 Put that again expires in 2 months.

First month... the market goes sideways as follows:

Week 1 - SPY drops from 100 to 90 (10 points = 10% move)

Week 2 - SPY rises from 90 to 100 (10 points = 11.111% move)

Week 3 - SPY drops from 100 to 90 (10 points = 10% move)

Week 4 - SPY rises from 90 to 100 (10 points = 11.111% move)

Now you still have 30 days left before you SPY 100 Put expires... but "Time Decay" would probably have cut the value in HALF! If you paid $5.00 for the put, it might be worth only $2.50 now. That's why you only have a 33% chance of winning when buying an option.

Let's now look at the same move, only with a 2x ETF:

Week 1 - 2x ETF drops from 100 to 80 (10% times 2 = 20% move)

Week 2 - 2x ETF rises from 80 to 97.77 (11.111% times 2 = 22.222% move)

Week 3 - 2x ETF drops from 97.77 to 78.22 (10% times 2 = 20% move

Week 4 - 2x ETF rises from 78.22 to 95.60 (11.111% times 2 = 22.222% move)

As you see... each time you go down the percentage move back up is calculated from a lower amount, thus you can never get back up to the original high. With the 2x ETF, after one month, you would be at 95.60 versus 100 on the SPY. You would have lost less time decay on the option, and it might even be worth more then your original purchase price. You then have a similar chance of winning (66%) just like doing credit spreads or simply selling options instead of buying them.

I recently bought puts on the SPY Friday at 1014 SPX. I plan on waiting until the UPRO and SPXU becomes more liquid. They don't have enough of an options market yet. FAZ and FAS has plenty, and I may look to buy puts on them again in the future. I didn't Friday because they already started down the day before, and SPX was rallying for one more time... in my opinion of course.

Dan Black

P.S. Thanks Douala, but I haven't setup a disqus account yet. So, I haven't posted on Evil or Slope, although I have been following them since about September of 2008. So I've been quietly reading every post for a long time (even seen Annamall change her Avatar a half a dozen times... LOL!). Maybe I'll sign up soon?

Cobra

ReplyDeleteI am new to TA. On your cycle lines how do you read what the blue or purple is telling you?

Kim,

ReplyDeleteI agree with you on EW. I am also very confused to the extent that I wrote Mr. Bob asking him whether he even follows his counts or not because lately EW predictions are terrible.

But here are the few things that I would like to mention:

Bob asked everyone go short on SP in Oct 2007 and asked every one to cover their shorts on Feb 23rd. I have read Feb 23rd commentary from Bob and it was spot on.

In early March, when SP was in low 700, EW predicted that SP would be at 1000-1100 before going down further. We all know how that came out to be true.

Now, he is asking evreyone to be short or in cash. I am not sure whether EW analysis considers Goverment intervention and especailly Goverment $ucks (GS) magic trades but yes, certainly EW was correct in the past. Thus, I wouldn't be betting big.

I, personally, moved my 401K to Government Bonds. Even if I miss another SP 100 points in next six months, I am fine but I am certainly not ready to lose 200+ points in SP at this point on my 401K.

As they, If you fool me once, Shame on you but if you fool me twice, Shame on me. I am not ready to bet on the Government numbers yet until employment problem is solved.

That's about 401K. On short term, I am going to trade along with the market. Because the market can stay irrational longer than the supply of our money. Thus, not betting the market but trading with it with small positions.

Hope this helps.

- Same EW Guy from above.

Anon of 5:14pm, all I can say is whenever blue or purple gets hit, there's a chance that the market makes a turn. Well, sometimes it doesn't work, this is in fact all TA indicators' common problem: sometimes they work, sometimes they don't.

ReplyDeleteEW guy, I agree with you. Thanks. I saw EWI's latest comments either.

ReplyDeleteCobra,

ReplyDeleteAre you sure you changed your long-term view to "up" at the right time? Did you check how many SPX calls were shorted last week or for that matter, since this head fake started in early July?

That said, I like your work a lot as you and Frank over at Trading the Odds are the most honest technical analysts out there. Keep up the good work!

Need a weekly STO>50 to confirm the new LT trend, imo.

ReplyDeleteAnon at 4:45am, thanks for remind me. Just I simply use "signal" to mark the current trend. Whether I believe or not is another story. Also it's true that I'll try my best not to trade against my signal. If I disblieve, I stand on the sideline or trade very lightly.

ReplyDeleteCorrect me if I'm wrong, but ISEE on all indices and ETF this morning hit 300?! I think that's the highest I've ever seen, no?

ReplyDeleteFrank