Summary:

Could be a sellable bounce as neither price nor volume were impressive on this rebound.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Up | ||

| Intermediate | Down | Neutral | Intermediate sell signals still need further confirmation. |

| Short-term | Down | Neutral | |

| My Emotion | Down |

I read a newsletter saying it’s possible that the pullback might be over. The reason is that the market rebounded right at Fib 23.6 which met the minimum pullback requirement, therefore if the market could rise tomorrow on strong breadth then the possibility should be confirmed.

3.0.0 10Y T-Bill Yield, looks like a bottom so this chart supports the argument for the “pullback is over”.

Personally, I believe the pullback is not over yet. The argument is that the rebound so far was not impressive in terms of both price and volume.

7.7.9 Russell 3000 Dominant Price-Volume Relationships, for 2 days in a row, the dominant price-volume relationships were all bearish “price up volume down”. This is my argument for “volume not impressive”.

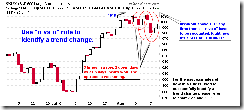

7.1.0 Use n vs n Rule to Identify a Trend Change, down 2 days vs up 2 days, apparently bulls were weaker. This is my argument for “price not impressive”.

So, I believe this is a sellable bounce. Of course as mentioned in chart 7.1.0 Use n vs n Rule to Identify a Trend Change, whenever SPX breaks above 1018 (say breakout tomorrow for example, but certainly it’d be not very convincing if it took another 4 days to break above 1018), the setup should be considered as failed. The following chart, 8.0.3 Use n vs n Rule to Identify a Trend Change 2008 illustrates how to use “n vs n rule” to buy dip/sell bounce. Overall, the setup was reliable. The most recent example is here, very breathtaking, where SPX rose 5 days in a row but couldn’t even recover its 1 day loss. Just the setup was very difficult to hold on while the market simply kept rising day by day. Another example is here, also very breathtaking, where bears spent 5 days couldn’t even match the bulls 2 day's work, but again it’s very difficult to hold the setup by witnessing the market dropping day by day. Well, hope this time it won’t be too breathtaking…

thanks as always Cobra, great work!

ReplyDeletetechnical question, how did you get stockcharts to show a 23.6% fibonacci level? thanks

nevermind,i discovered the control function with the fib tool.

ReplyDeleteNormalized CPC is rising into the bullish range. When that line starts to roll over, it is normally a bottom. Surprisingly, I tend to agree that we're closer to a bottom than top (in terms of price). It doesn't mean the market won't put in a new near-term low soon, but I doubt it will be deep and it should be buyable. In other words, it is probably time to scale in on the long side on dips and increase positions when Normalized CPC begins to fall. There may be more money to be made on the long side in the very short-term.

ReplyDeleteCheck a longer chart you'll see that the current normalized CPC isn't high enough for taking a long postion. I mean just use this indicator.

ReplyDeleteDamn... are you sure! a week ago you were sure we were going up.

ReplyDeleteVery Worthwhile:

ReplyDeletehttp://www.traders-talk.com/mb2/index.php?showtopic=110073

Regards, Jim P.

Anony at 5:37am, a week ago? You sure you remember correctly?

ReplyDeleteJim, thanks for the link. That REALLY good!

ReplyDeleteCobra, quick question. On the N vs N rule chart, how is the first circle a bear victory? I see two down days followed by two up days which closed higher than the two down days. Thanks.

ReplyDeleteBecause not higher than 1018, should count the previous swing's highest point.

ReplyDelete