Summary:

Simple list of some short-term "bear friendly" signals.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Up | Overbought | |

| Short-term | Up | Neutral |

Nothing new to say, most agree that big picture is up, just have different view on when short-term will pullback or even if there’s ever going to be any meaningful pullback. Short-term, I have one more reliable overbought signal triggered today, T2112 % of stocks trading 2 std dev above MA40 from Telechart, hitting a new record high. The last time, it was this high a little bigger pullback happened, see blue curve marked by a red cycle. Also now SPY has 9 unfilled gaps, so I still expect a short-term pullback soon. Just as the After Bell Quick Summary mentioned, because CPC < 0.8, so 77% chances a green close tomorrow, this means that the pullback may not happen tomorrow.

Simply listed below other “Bear Friendly” signals for your references:

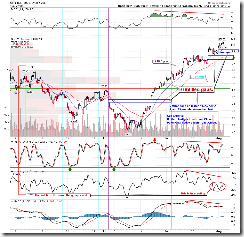

1.0.2 S&P 500 SPDRs (SPY 60 min), 9 unfilled gaps plus lots of negative divergences. The most notable part is that ChiOsc was negative all day which means that volume didn’t confirm today’s rally.

Speaking of volume, take a look at the daily chart, 0.0.2 SPY Short-term Trading Signals, up 3 days in a row, but volume down 3 days in a row, this is a so called price-volume negative divergence which in the PAST often led to a pullback. Anyway, pay attention to the volume, if we have yet another up day tomorrow.

T2103 Zweig Breadth Thrust from Telechart, overbought.

T2122 4 Week New High/Low Ratio from Telechart, overbought. Well it still has a little bit up room though.

Cobra

ReplyDeleteYour thinking too much on 'gaps'. With so many computer trading program it doesn't care if gaps get filled or not.

Not sure if you were trading 10 years ago but intra day move was nothing like today.

Thanks for great works...

Dear Cobra,

ReplyDeleteA nice pullback to 97 would definately help, but it is hard to believe 1000 isn't going to be defended here. I'm sure a lot of stops were set up today, so we may get a dip below 1000 to blow them out, but not sure we can close those two most recent gaps until much later.

Just my big picture view. Thanks for all the hard work even though you may feel the effort is futile right now.

Best to all,

-A.

AAII bulls were only 47%, decently bullish but they should go above 50%at least for a top.

ReplyDeleteMcClellan Oscillator components were at the highs of the year: 10% 775 5% 550ish

Other yearly high levels: Jan 6 774 (10%) 388 (5%)......May 8 687 (10%) 523 (5%)....

Psychology-wise, I feel like I have been pummeled by a baseball bat all day today (even though SP is only 5pts above its high 2 days ago) and I have no interest in adding to shorts which is probably how I should feel at a top.

----Mr. Panic

Mr. Panic, that "baseball bat" feeling is really interesting. Haha

ReplyDeleteHi Cobra -- Thanks for your continued efforts in a very difficult and confusing timeframe, they are appreciated.

ReplyDeleteLooking at the low volume and given the obvious manipulation in play, I was just thinking that high volume may just never return.

The market has always been structured to screw the most people, so even if the bears become extinct - you gotta believe the bulls will get theirs unless you were early to this ponzi scheme market. Anyone buying into the current bullishness will pay the price one last time...the market will never recover.

There is no telling where this rally will end, but I do not recommend holding long positions overnight for the coming weeks. The Fed has some key auctions coming up next week. If the dollar continues its plunge, the only choice left will be for the Fed to crash the equity markets and create a flight to safety. It's a possibility that would make me scared to hold a long position overnight.

ReplyDeleteActually, the host who commented on the 60% AAII bulls on his radio show is affiliated with AAII and often speaks at their events. He might be talking about the upcoming number which has yet to be released to the public. It makes sense. It took an awfully long time just to get 47%bulls.

ReplyDelete----Mr. Panic

Cobra:

ReplyDeleteThank you for continuing to publish a great blog.

When you have a minute, please post the daily seasonality chart for August.

Thanks again!

If anyone still thinks we're going to 1200, read this article first...

ReplyDeletehttp://www.howestreet.com/articles/index.php?article_id=10333

Dan Black

Mr Cobra

ReplyDeleteThank you for all your hard work. I hope life will richly bless you for sharing it with us.

[Note to Mr Panic... I feel like a truck has hit me and just keeps backing over me since April.]

Bulls are becoming powerless. A constant supply of positive surprises would keep the rally going, and thats unlikely to happen.

ReplyDeleteI think we will price a double dip recovery soon, that means we will retrace back to under 900.

More like 1929-30 than 2003.

BTW short-term shorts will be happy if we put a shooting star candle today.

Bob

Today volume is lower than yesterday on SPY.. HAHA 4 days in row. Volume is going down and SPY's are closing in GReen.. Nice Job Govt. Shit (aka GS)

ReplyDeletewhat if, market keeps its happy time with lower and lower vol, and still not gets enough people to jump the ship, does GovShit dare to dump th market?

ReplyDeletei'm sure they will make some fake pall-backs before the real one - and those fake ones will still kill - so how to identify them?

i'm waiting for my bite.

Market will never ever - ever ever - go down...

ReplyDeleteCaterpillar projected 2012 (why not 2050)earnings and it went up almost 5% in a day... Geez... That's insane..... That's too much money from the sideline is coming in - just to feed Government Sucks (GS) profit line. Retailers in and Government Sucks out... Then retailers are stuck with real $hit...

That's "Change" we were really waiting for....

market will go down. the question is when.

ReplyDeletewhat really worries me is how to distinguish the real pullback from fake ones - since bears like me are so 'ready' to give a big bite, just don't want to dent my teeth on a bone.

Bears be patient, that's all I could say. I like what Jason of www.sentimentrader.com said the other day:

ReplyDeleteEvery day, it seems like we're playing Russian Roulette with everyone else and one of these days the buyers will get a live round. But until then, we're nervously hearing that empty click every time sellers try to pull the trigger.

take it one day at a time..no need to have a bear or bull mindset...just market heading up or down in the time frame we trade....helps keep the trader in the moment and trading whats in front...of me..rather than what it should do..this market should have gone down a few days ago.but it did not.

ReplyDeleteit could go down any day..but it isnt down till it flips any ohter mindset of what it should do..and when..is detrimental if you are a short term trader...its a IF /THEN world....not a SHOULD/THEREFORE

caution: dont know about anyone elses experience..but beware too much analysis and overconfidence and denying what we see, in real time...which is reality..

P/S shorting.. isnt the only way to make money, that is if making money is the REAL goal here....otherwise the real goal is to make money thru shorting....HUGE difference.!!

ReplyDeleteBeware the subtle influences...

dan black@7.52am, i think the s&p can do 1100-1200 this year, while the dow will likely and easily take out 10k.

ReplyDeleteanon@3:50pm - on what world are you seeing bulls powerless? the reason this market keeps going up is because many are still as yet unwilling to give this bull the respect they should. fact is bulls are in control here, and although they seem illogical in their position, we need to respect their power and strength with every short trade we attempt. although institutions are not participating much on the upside move, they do step in on dips to lend support, even in a very overbought market. that has longer term bullis implications.

it seems to me that an appetite for risk is coming back into this market and that usually means higher prices - if u think euphoria and complacency is here - just wait and see where we are by year end.

to 'the small fish':

ReplyDeletedo you have any proof that 'institutions are not participating much on the upside move'?