Summary:

The rebound is not impressive in both price and volume.

Could be a pullback at least tomorrow morning.

Top not confirmed by CPCE but according to "n vs n" rule, market still could be topped.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Up | ||

| Intermediate | Down | Neutral | Intermediate sell signals still need further confirmation. |

| Short-term | Down | Neutral | |

| My Emotion | Down |

I’m not impressed by today’s rebound in terms of either price or volume.

7.1.0 Use n vs n Rule to Identify a Trend Change, the rebound is not big enough so it makes very difficult to breakout above SPX 1018 tomorrow, therefore even the market is up tomorrow, according to “n vs n” rule, bear might win again.

7.7.9 Russell 3000 Dominant Price-Volume Relationships, 1458 stocks price up volume down which is the most bearish relationships among the 4 different kind of price-volume relationships.

Bottom line, if the market is up tomorrow but both price and volume are not strong enough, then according to 7.2.1 Buyable Pullback Rule, the rebound could be sold.

I expect a red close tomorrow. Except the simple statistics mentioned in the After Bell Quick Summary, a few chart patterns also support a possible pullback.

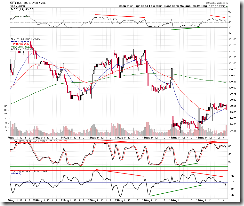

1.0.2 S&P 500 SPDRs (SPY 60 min), looks like a very typical Head and Shoulders Top breakdown and then back test the neckline, so it could mean a further pullback. Also today is the end of 7 trading day cycle, so it’s very likely the market reached a high point today and may turn down tomorrow.

1.0.4 S&P 500 SPDRs (SPY 15 min), lots of negative divergences, this may mean a pullback at least tomorrow morning.

The potential top signal mentioned in yesterday’s report didn’t get the confirmation today: 2.8.0 SPX:CPCE, trend line didn’t hold. This is a good news for bulls, but as mentioned above, bulls might have lost the “n vs n” battle therefore it’s still possible that more pullbacks ahead. Take a look at 8.0.3 Use n vs n Rule to Identify a Trend Change 2008, if you have time, to see how the market was topped while bulls kept losing “n vs n” battles.

Discussing the rally with Louise Yamada, (Technical Research Advisors) and Carter Worth, (Oppenheimer Asset Management). http://www.cnbc.com/id/15840232?video=1218503502&play=1

ReplyDeletethis link shows the comparison 1938 to 1942 charts ----http://img34.imageshack.us/img34/4332/1938yamada.png

Where do you think we're headed?

ReplyDeletehttp://www.bestmindsinc.com/documents/ium_102yearchart.pdf