Summary:

No conclusion, small body bar formed today could mean a continuation or reversal.

Could be a Head and Shoulders Bottom formed on the TLT daily chart.

Zweig Breadth Thrust is overbought.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Up | ||

| Intermediate | Up* | Overbought* | Further confirmation needed for the intermediate-term buy signals. |

| Short-term | Up | Neutral | |

| My Emotion | Up | Still think this is a bear market rally. |

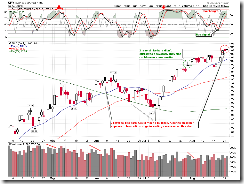

0.0.2 SPY Short-term Trading Signals, the small body bar formed today could mean either continuation or reversal, need to see tomorrow. Please refer to 7.2.0 Small Body Bar Trading Rule for more discussions about small body bar.

0.0.3 SPX Intermediate-term Trading Signals, SPX was rejected again under the Bearish Rising Wedge resistance line. Although there’re lots of negative divergences, but since buy signals were triggered by MACD and NYSI, so today I upgraded the intermediate-term to buy from sell.

7.0.A Major Accumulation Day Watch, as being discussed recently, according to the past pattern if the SPX wasn’t down 2 days in a row then odds are that the uptrend would continue. Just, by comparing with all the dashed green lines, the follow-through we had in the past 2 days after last Friday’s Major Accumulation Day was weak. A similar case was marked with blue cycle on the chart for your references.

Bottom line, I have no evidence to prove that the market is topped while short-term I need to see how market unfolds tomorrow.

Two interesting charts for your info only:

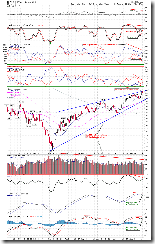

3.0.3 20 Year Treasury Bond Fund iShares (TLT Daily), could be a Head and Shoulders Bottom in the forming.

T2103 Zweig Breadth Thrust from Telechart, overbought.

what does mean if TLT break up the HS patter? does it mean the money is shift to treasure, then the stock market will go down?

ReplyDeleteCould be.

ReplyDeleteThanks Cobra

ReplyDeleteIMO, TLT H&S doesn't look very clean as the shoulders are quite different size, one is quite wider than the other, and bottom at widely different price levels...I wouldn't put too much into it.

TRAPPING SHORTS AGAIN?

ReplyDeleteI would not be fooled by two bearish candlesticks. Big boys know shorts are grasping to any signs they can for the impending move down. They will steal the lunch money until the little guy makes a stand. Wait for someone to make a stand before getting bearish.

At least wait for 5, 10, 20 moving avgs. to point down first.

Although, it seems at looking at charts, trading outside of the Bollinger Bands is a key ingredient to reversals...at least that may be a first step.

We should have a nice decline start tomorrow. Nasdaq just got a sell signal today on an esoteric signal (which the big boys trade on); SP already had one. I was looking for two closes in this new range with small bodied candles (which is a feature of all the great tops) and we got them. When McClellan oscillator drops below the 0 line this time it's going to stay below it for a long time (and about any decent down day will get it below the 0 line) Negative divergences on RSI, $nymo , $nysi at these highs.

ReplyDeleteSentiment is extra-exuberant.

-----Mr. Panic

Cobra, as always great job. Can I make one recommendation? Not sure if you are doing it on purpose but is there any way you could change your site feed settings to get the full post in reader?

ReplyDeleteBlogger > Settings > Site Feed > Allow Blog Feeds - Full

This way I get your morning review on my iphone while waiting in line at dunkin donuts =)

Keep up the good work. Also look back at Jan 5th this year. We had 3 strong up bars, 2 spinners. Looks exactly like our formation and during the nov to jan rally we had 5 cycles, just as we have completed now.

Hello Cobra,..

ReplyDeleteIn reply to your question from yesterday...asking me if I am still using the cycles you charted for me,..the answer is yes. There might be a slight modification to one of the four cycles,..but basically, my likely pivot dates do not change once they are calculated. Next 3 wk cycle 9likely pivot) dates are today Wed 08-26, then next is Fri 08-28, then Fri 09-04. Perhaps next week I wll re-calculate these dates into October, etc. And will post them here. Have a good day. Regards, Jim P.

Chaugner, done! Let me know if it works?

ReplyDelete