Summary:

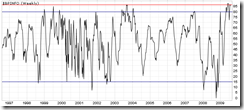

The common believes are that the bigger picture is up.

Expect a short-term pullback.

| Trend | Momentum | Comments - Sample for using the trend table. | |

| Long-term | Down | Idea for trading intermediate-term under primary down trend. | |

| Intermediate | Up | Overbought | |

| Short-term | Up | Neutral |

Nothing new to say. The chart below is what I understand that most believes, just the price target and the time target are my best guess.

I have no idea whether the common believes are true or not. Just the “vacuum” between NYADV and NYUPV in chart 0.0.3 SPX Intermediate-term Trading Signals still gets me worried, though it’s not a reason to short, but personally I won’t long if I don’t see a little bit bigger pullback.

Short-term,After Bell Quick Summary has mentioned a possible red Monday. In addition, here are 2 reliable signals.

T2103 Zweig Breadth Thrust from Telechart, overbought.

T2122 4 Week New High/Low Ratio, overbought.

Besides, 1.0.2 S&P 500 SPDRs (SPY 60 min) and 1.1.0 Nasdaq Composite (Daily) have too many gaps, so I still believe at least one gap should be filled within a short period of time. The Tech Bullish Percent Index as shown below again hit almost new high now, so at least Nasdaq has a better chances to fill at least one of its gaps.

Thanks for all your excellent work.

ReplyDeleteIt's hard to believe a scenario where the market hits 1200, simply on valuations alone it makes absolutely no sense, but then again, we've had tech bubbles and housing bubbles, so I cannot assume rationality in the markets. The forecasting models I follow suggest we are close to the top for the year. It makes sense, because I don't see how the news could get any better. I mean, the recession is over, right? Let's just say there is more room for disappointing news in the coming months than more "upside surprises". Gravity should take over.

ReplyDeleteLooks like we have intermediate top early August...I agree I don't see 1200 for long time. Most likely top out mid November and close the year 105-110

ReplyDeleteAwesome!

ReplyDeleteMarket will plunge next week

ReplyDeleteDr. Doom: market has been plunging every week btw.

ReplyDeleteNouriel Roubini says "We may be out of a freefall for the financial system, we have seen the worst in that sense. But in my view there is a sluggish U shaped recovery that might go into a W double dip if we don't fix the problems in the economy."

ReplyDeletethen near the end of the interview, his says that he doesn't believe the march low will be retested....

http://www.cnbc.com/id/32012679/site/14081545

http://www.rgemonitor.com/166

That's nice to hear but I see a few big bombs coming on big banks. FDIC insolvent per Denninger?

ReplyDeleteIn order for the markets to retest the lows of March, there has to be complete disruption of the financial markets again. This seems unlikely because the government has somehow convinced people that the US banks are okay.

ReplyDeleteThe only thing that will cause a retest of the markets will be something completely unforeseen and out of control of the hands of GS and the Plunge Protection Team. For example:

1) Large European banks fail because of Eastern Europe, which cause a domino effect around the world

2) US dollar tanks because China aggressively takes an anti-US stance

3) California defaults on its debt

etc.

These are true "black swan" type events. I think as it stands now, we're not headed towards retesting the lows, even with a crappy impotent economy.

Looking like to da moon this morning.

ReplyDeleteFutures are pumping +10 on SPX.

Hello Cobra,...

ReplyDeleteI am biased for a Lower close on Tuesday.

Reasons include:

o Tomorrow, Tues 08-04 is my next 3 wk cycle (likely pivot) date,...being 13 mkt days from Thurs 07-16. I am expecting Thurs 08-04 to mark a turn down from a high.

o Both SP500 and VIX are UP today (Monday 08-03) at least as of 3:50 pm as I type this.

o Other cycle method suggests a Low on Wed 08-05

For these reasons, I am looking for a lower close on Tues 08-04. Thanks for sharing your work.

Regards, Jim P.

Jim, VIX doesn't seem to work recently. We had both SPX and VIX up last Friday, but look at what's happening now. The CPC reads at 0.74 and this means 77% chances a green close tomorrow...

ReplyDeleteI think we will see-saw around till the end of the week. I can't see them (Bulltarts's) not going for the 50% retracement at 1014. It's too close. Besides that... it should scare out the last Bear. As for a correction, I'm still planning on going heavy short this Friday, one week ahead of the predicted August 14ht crash date. We'll see?

ReplyDeleteDan Black

The media hype should get extreme with SP500 closing above 1000. Now we have to contend with all of the new month money coming in for the next few days. SP 1007 should be resistance but who knows; this is getting frustrating. I did hear on the radio that AAII bulls was %60 but I haven't confirmed. Maybe we hold up until the next round of sentiment polls are released.

ReplyDelete---Mr. Panic

SPX 1014 is 100% and 1040 is 50% chance right now.

ReplyDelete