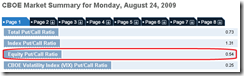

I expect a red close tomorrow because CPCE was closed at 0.54. Counting the dashed lines on the following chart, the odds are high a red close next day whenever CPCE was closed below 0.56.

Please note that my winning rate for predicting the next day’s close ever since the first After Bell Quick Summary was posted (around June) on this blog was above 70% EXCLUDING OE WEEK. If OE week was counted however, the winning rate is just above 60%.

Disclaimer

The information contained on this website and from any communication related to the author’s blog and chartbook is for information purposes only. The chart analysis and the market recap do not hold out as providing any financial, legal, investment, or other advice. In addition, no suggestion or advice is offered regarding the nature, profitability, suitability, sustainability of any particular trading practice or investment strategy. The materials on this website do not constitute offer or advice and you should not rely on the information here to make or refrain from making any decision or take or refrain from taking any action. It is up to the visitors to make their own decisions, or to consult with a registered professional financial advisor.

This websites provides third-party websites for your convenience but the author does not endorse, approve, or certify the information on other websites, nor does the author take responsibility for a part or all materials on the third-party websites which are not maintained by the author.

According to stockchart, $CPCE=0.63. Why it's 0.54 in the left figure? Which one should be more reliable? Thanks!

ReplyDeleteCPCE readings on stockcharts are wrong until 7:40pm ET. This is a known problem for long long time. I've past the offical CBOE readings above, that one is final.

ReplyDeleteCobra daxia:

ReplyDeleteis this a BSO? :p

"Please note that my winning rate for predicting the next day’s close ever since the first After Bell Quick Summary was posted (around June) on this blog was above 70% EXCLUDING OE WEEK."

thx, ding

ReplyDeleteAnony at 6:10pm, no, it's not BSO, it's far worse than I thought, even I was lucky to have CPC/CPCE/VIX to help me recently. This means that I couldn't even achieve this rate in the future.

ReplyDeleteThanks, laoda!

ReplyDeleteAnonymous, I thought you were going to tell us more about your esoteric sell indicator you talked about yesterday that was triggered.

ReplyDelete70% is a very impressive number. I do not do day trade, otherwise I could follow. Thank you for your hard work.

ReplyDeleteThese numbers don't include the day I didn't predict the next day. For the past 58 trading days, I just forcasted 32 days. Buy close and sell the next day close resulted in 70% winning trade excluding OE week. But maybe the rest 30% losing trades lose much much bigger, I didn't count this yet - I will calculate this later.

ReplyDeleteThanks, Cobra.

ReplyDeleteSo .. shell we revese you charts during OE week and get 80% ratio?.. LOL.

ReplyDeleteAnton, maybe. For the last month OE week, I was wrong 3 days in a row and this month agan, wrong 3 days in a row.

ReplyDelete70 % right is dam very good.

ReplyDeleteNinja, I don't expect I'll have the same rate in the future because the rule I found on CPC/CPCE/CPCI/VIX won't remain the same in the future.

ReplyDeleteCobra, the options rules will always work but be careful about fixing certain values to make your rule. For example, CPCE < 0.70 as a sell will probably not be true as conditions change. The options ratio changes enough over time that the rules should really be around deviation from shorter-term moving averages than around fixed values. But my research shows that in the short term, some simple rules on CPC ALWAYS work. A falling normalized CPC is bullish while a rising normalized CPC is bearish...always. Right now, CPC is falling so until it starts rising, the market will generally move higher, even if tomorrow is a down day, unless signals change based on tomorrow's close.

ReplyDeleteGordon,

ReplyDeleteI already have talked about that indicator on another message board. Nasdaq has to close +4points tomorrow to trigger a sell and on the 60minute we probably need four or more strong bars for SP. SP daily has by my count easily hit its sell target. All I am looking for are two closes in a new high range and we got one today. 1987,2000,1929 all had two closes in the new final high range and they were all dojis or shooting star patterns; none were big-bodied candles. Shanghai a few weeks ago really only had one bar at the new top range. SP is 17% above its 200day moving average which historically is about as over-extended as it gets; only August 1987 was as high(I have to research 1929). Elliot Wave wise, this was wave 4 off last weeks low; we should have one more surge to new highs but it will probably just be an intra-day affair.

----Mr. Panic

sorry, I meant CPCE < 0.56 as a sell may not always work if the ratio is averaging a much lower number

ReplyDeleteYeah, I've got you. I'll do research about put/call ratio. Hope they could be powerful tools forever. Thanks.

ReplyDeletebe sure to exclude any data that disproves your Theory.

ReplyDeleteSo...

"Expect a pullback next Monday at least in the morning."

Somehow that is a Mid day reversal?

and the Dow was Green.

I think we need to vote on if you are right or wrong!

I've already excluded things like "a pullback at least in the morning". I only count days like today which I clearly said "expect a red close". I even count "expect a red close, not sure though" as a forecast which if I don't count, the winning rate is even higher. I have a spreadsheet detailing every of my count. But anyway, as I've been saying, I don't expect this kind of rate in the future.

ReplyDeleteOh, the count is for SPX close only.

ReplyDeleteThanks Cobra, let's hope tomorrow it gives us a buyable dip.

ReplyDeleteJust the purpose I mention this rate here is, I don't agree someone said the other day that what I've been doing is like flip a coin. This is unfair if this one knows how much work I put here, no matter it's useful or useless, after all, it's free and this is a free world.

ReplyDeleteCobra,

ReplyDeleteI just love your Blog. Even tomorrow turns out not to be the color you predicted, I still think your techinical analysis is the most logical one. We all know trading is all about probability.

Someone actually said its like flipping a coin? Clearly whomever that was has no idea that the stock market is all about probabilities and taking a hard line stance will just get you hurt. I much prefer the probability based approach that you take, which is one reason why your site is on my must visit every day.

ReplyDeleteI support Cobra and thank him for all the work he has been doing.

ReplyDeleteSo if someone doesn't like it, don't ever come here.

Nothing, No TA tools or charts are 100% 'accurate' - all what we care are possibilities and their weights: if the weighted sum is positive, we win.

As simple as that.

Once again, thanks Cobra.

dont listen to the haters....

ReplyDeletethis blog is the most objective NON bias, cumulative twice a day summary of TA on the frigging wed..

TRADE THE ODDS is a close 2nd....

dont listen to the haters,

if your not netting a couple G's a month just from donations, then its a greedy world we live in, thats my opinion

excellent discussion.

ReplyDeleteThank you guys for supporting me! Really appreciate.

ReplyDelete